Team members

79

Revenue in cash receipts

$1.02m +2.7%

MRR

$1.02m +3.3%

ARR

$12.2m +3.4%

Debits

$822k +3.8%

Profit

$192k +57%

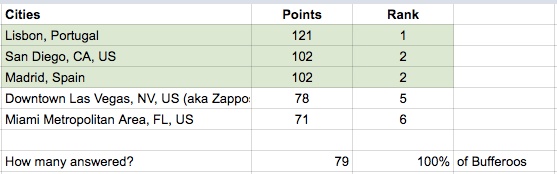

Organizing our next retreat: Location, location, location

As we continue organizing our next retreat, we’re excited to bring the team together in one of the three following locations: Lisbon, Madrid or San Diego!

We find that taking a “best out of 3 approach” helps the People team have more confidence in the level of service we can offer the team in each location, and at what cost—we’re striving to be very lean in our next retreat, so cost will be a major factor here.

At this stage, we’re having several conversations with vendors, hotels and coworking spaces, and we’re gearing up for flying to some of those locations for a scouting trip—more excitement to come!

Long-term cash planning: Understanding unit economics

As of October 31, we have $1.75m in the bank. This is in line with what we had forecasted—slightly better, even! We want to be and remain cashflow positive.

As such, we’d like to manage our cash a bit closer and improve our forecast for future earnings. As a company, our aim is to build a healthy bank balance and continue building a sustainable business—this means setting quite a bit of cash aside and trying to examine each potential spending decision with more scrutiny than before.

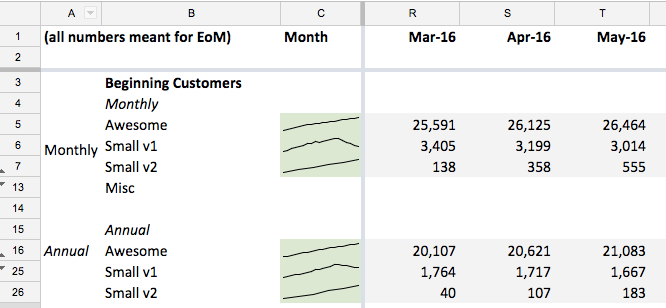

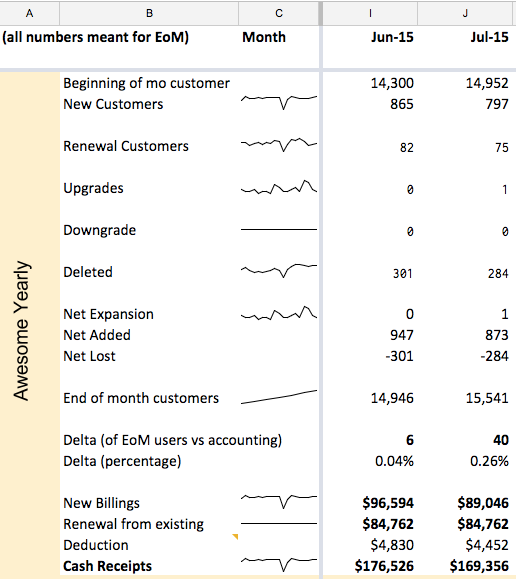

Julian and I have been working on predicting Buffer’s revenue to a higher degree of accuracy, and to do so we created a skeleton model:

This is a helpful exercise data we got from Looker and then added a financial lens. The goal is to be able to predict with a high degree of certainty how each of our Buffer plans is doing, and become better at making product decisions based on what we’re seeing in terms of user journeys.

We wish to get better in terms of unit accounting, or tracking individual products or plans. We’re currently only observing variations of about 0.31% on our largest plan (illustrated as “Delta” on the table below) – which is helping us build confidence in our model.

We’re excited to start spotting trends and going from our raw MRR data to a more granular, per-plan estimate of monthly cash receipts.

When we account for monthly revenue, it’s pretty straightforward: we only need to take the number of plans we have and multiply the monthly plan.

From “MRR” to “Revenue,” for Monthly Plans:

- (FYI) Billings (MRR added) = (Net Added) * Monthly plan price

- Recurring Revenue = (End of the month Month Customers) * Full yearly plan price

- Deduction = A guesstimated 5% rate accounting for Stripe fees and past-due transactions

- Net cash receipts = Recurring Revenue – Deduction

For our annual plans, there’s an interesting twist to account for monthly or annual revenue.

From “MRR” to “Revenue”, for Annual Plans:

- New billings = (New Customers + Renewal Customers + Upgrades) * Full yearly plan price

- Renewal from Existing = (Number of Annual Plan renewed that month * Full yearly plan price)

- Deduction = A guesstimated 5% rate accounting for Stripe Fees and Past-due transactions

- Net cash receipts = New billings + Renewals from Existing – Deduction

Now that we’ve backfilled our most popular plans, capturing 80+% of our customers, we’re looking at “mock estimating” the month of October that just ended to see how well we can start forecasting revenue ahead, on a per-plan basis – more to come soon!

Over to you

Do you have any experience hosting a group in the cities of Lisbon, Madrid or San Diego? Which would you choose? Is there anything you’d love to learn more about? We’d love to hear from you in the comments!

Check out more reports from October 2016:

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.