Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our default to transparency value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here.

We've emerged from a challenging year, one that proved our resilience and gave us a renewed sense of optimism heading into 2021.

We spent much of the final quarter of 2020 leaning into the inspiration we gained from the adaptability and strength of our customer’s stories. We observed countless companies shift quickly to remote work, an evolution of work that we always thought would someday come. We reflected deeply on our purpose, questioning how we'd show up for our customers to help them expand their positive impact and grow their brands and businesses over the next decade. We invited the company's first Chief Product Officer to join Buffer's Executive team and we committed to refining the company's purpose, vision, and mission. We established strong company-level OKRs, and set ambitious goals for 2021 and beyond.

For another reflection on 2020, check out this review of Buffer's 2020 in Numbers.

With January just behind us, we're already realizing the exponential impact of optimism, resilience, and a cohesive leadership team in service of the entire team's execution of shared, ambitious goals. We're moving quicker and raising our bar in support of small businesses. We've re-committed to being bold, increasing the value of the essential tools we offer, while maintaining our strong foundation of Buffer values and integrity.

This year already feels so different.

We've just launched Buffer's new engagement tool as the newest feature in our full stack of brand building tools and in response, saw the highest number of daily trial starts we've seen in awhile.

Along with Buffer's engagement tool, we're focused on adding value for customers, improving accessibility, and providing more opportunities for active engagement by leaps and bounds. We're also hiring several roles this year.

We’re looking forward to what’s ahead in 2021. Let's take a look at our financial results for Q3 and end of year outlook.

Financial results from Q4 2020

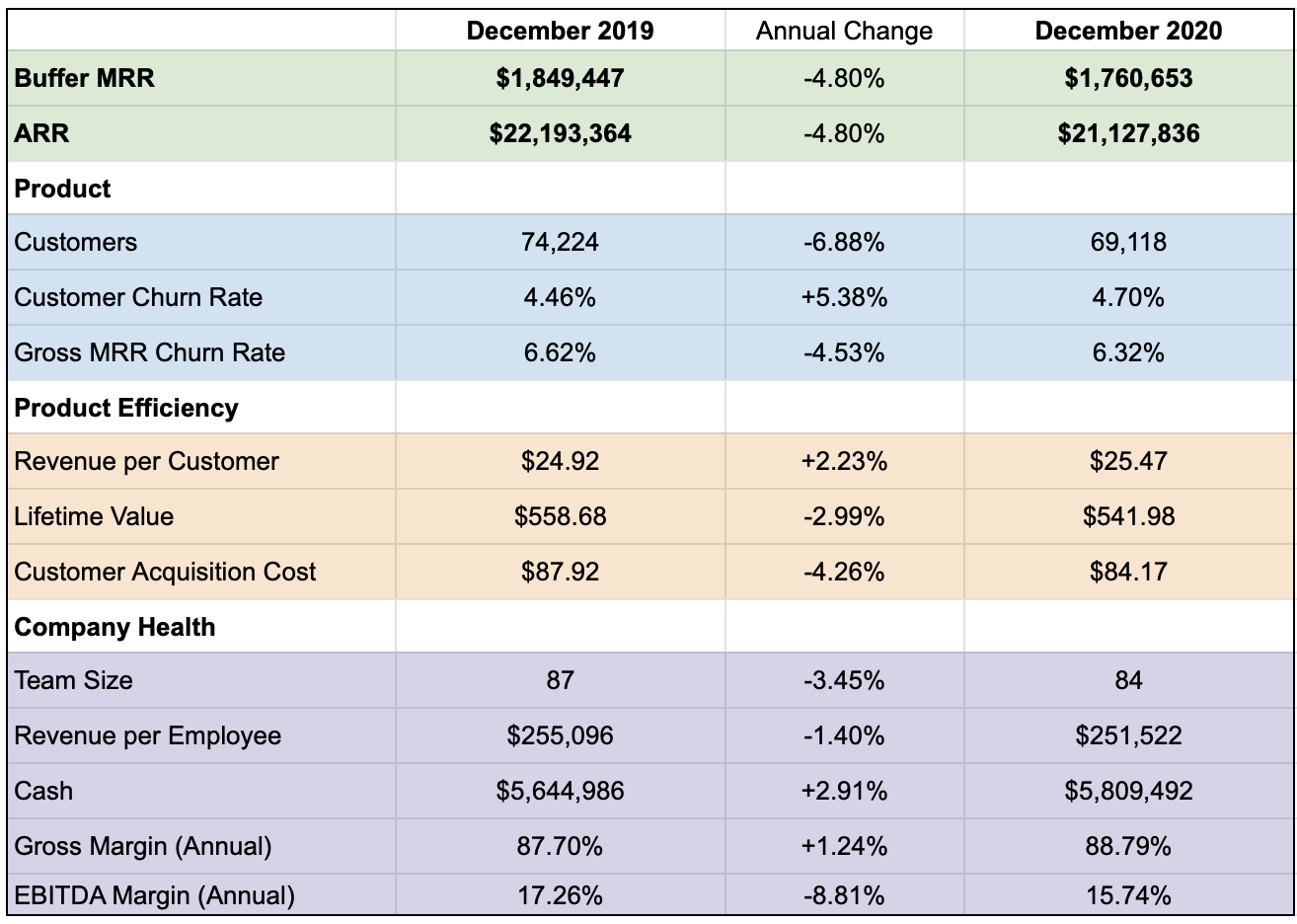

Q4 2020:

- Total operating income: $400,471

- EBITDA margin: 7.69%

- MRR: $1,760,653

2020 end of year:

- Net Revenue: $21,080,452

- 2.30% YoY revenue growth

- Operating Income: $3,318,234

- EBITDA Margin: 15.74%

- MRR: $1,760,653 (down slightly from end of Q3 MRR $1,761,962)

- ARR: $21,127,836

- ARR Growth Rate: -4.8%

Metrics

What else would you like to see?

This is the update that goes to Buffer shareholders, but I’d also love to hear from you. Are there other metrics or financials that you'd like to see from us? We're working on building and delivering a new level of transparency this year and I'd love to hear what you're most interested in, send me a tweet with your thoughts.

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.