Kat Boogaard’s journey into freelance writing isn’t all that unique: She was working full-time in marketing but yearned for more flexibility, creativity, and control in her work. Reflecting on her past projects and assignments, she noticed that writing was a common thread. So, she quit her full-time job to build a freelance writing business.

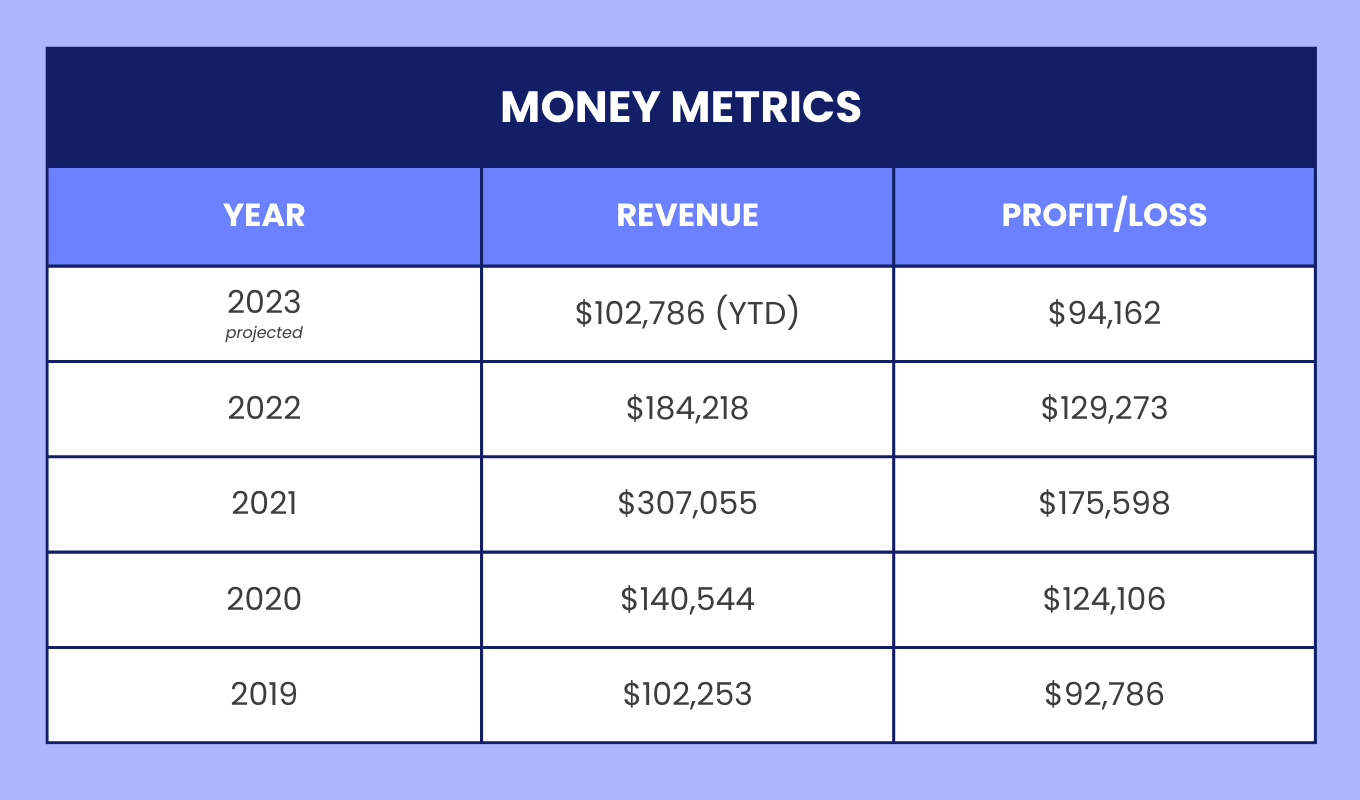

Her growth path, however, has been pretty uncommon. For one, she has built a stable and viable business, achieving six figures in revenue every year for the past five years and even bringing in multiple-six-figures in 2021 when she expanded her business with subcontractors. But, she’s also made the intentional decision to scale back over the past couple of years, stopping her work with subcontractors, cutting down client projects to what she could manage on her own, and reducing her revenue by over $100,000.

Below, she shares more about this new direction, the ways that decision has helped her life grow, and her advice for anyone trying to grow as a freelancer—on their own terms.

Years in business: 9

Number of employees: I subcontracted really heavily a few years ago, but now it’s just me.

Location: Appleton, Wisconsin

Initial capital invested: Very little! All I really needed was a computer and a reliable Internet connection. Investments in things like accounting software, my LLC paperwork, and some initial office supplies my first year in business added up to only $1,629.43 (and that included health insurance).

Financial support for business: I had family support while I got my business off the ground. (I was living with my boyfriend—now husband—who covered rent and food, and my parents pitched in where they could, including paying my car payment for one month.) I also received a $20,833 PPP (paycheck protection program) loan during the pandemic.

Revenue streams:

- Freelance writing blog posts and ebooks for software clients in the “world of work” space

Creating resources and publishing advice for fellow freelancers (a modest slice of income, $4,000 to $11,000 per year)

Growth Journey

What’s been your proudest financial achievement as a business owner?

I’m most proud of the year that I paid over six figures to other freelance writers through subcontracting. This was 2021, when there was a lot of uncertainty and struggle in the freelance community. I was thrilled that my business had the credibility to successfully ride those waves—while also pulling other freelancers onto the boat with me. It was so rewarding to go beyond sharing advice and offer real opportunity and income to other freelancers.

Subcontracting was something I resisted for a long time, both because it seemed intimidating and also because I felt like I was taking advantage of other freelancers by getting a slice of the work they were doing.

But I found ways to make it work for my business and other freelancers by:

- Only taking assignments that warranted a high enough rate that I could pay subcontractors more than fairly while still keeping a percentage

- Raising my rates with clients that were overdue for a price hike

- Creating defined processes so that subcontractors could focus on the creative work and not the logistics

It also took a while to figure out the cash flow because I’m a cash-based business that does primarily Net 30 payment terms. That meant I was often paying subcontractors for their work before I actually got paid. But my accountant (and my actuary husband) were super helpful in figuring out how to set enough aside so that I could pay my subcontractors within 24 hours of receiving their invoice, even if the client took several more weeks.

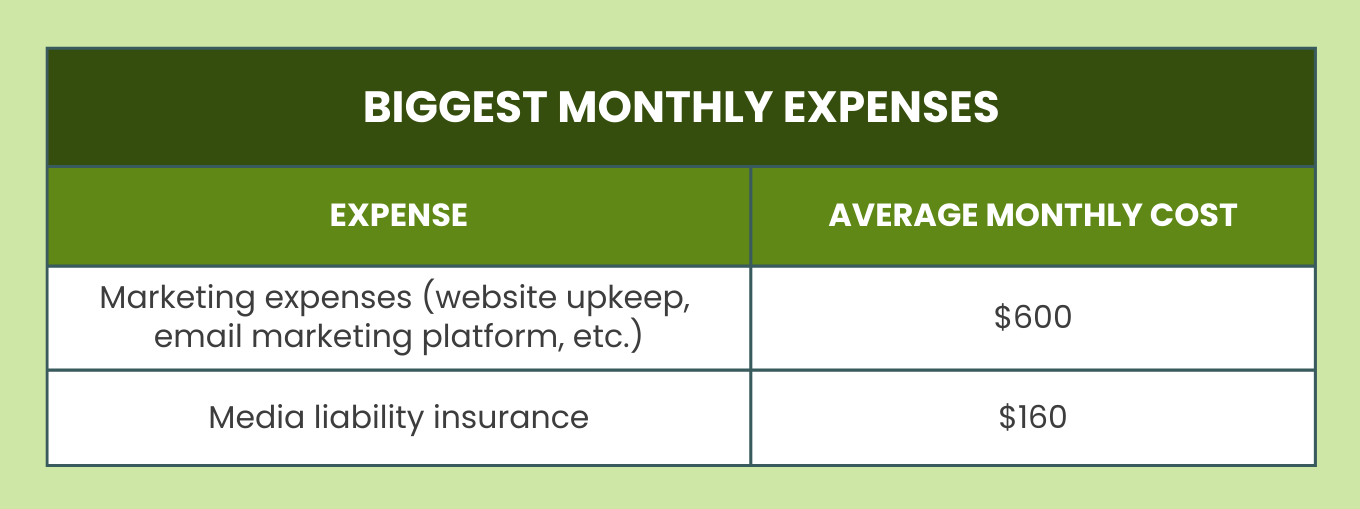

What have you found is worth paying for to help you grow, and what have you been able to achieve more scrappily?

Some things I’m always happy to invest in include:

- Qualified professional help: I quite literally don’t know what I’d do without my accountant. From quarterly estimated taxes to sales taxes on my products to my end-of-year return, he makes that whole process a breeze. Plus, the peace of mind I get from knowing it’s all taken care of correctly is priceless. I also have two lawyer contacts that I can reach out to for advice and resources. One helped me set up a contract template that I use when onboarding new clients, and now sell for other freelancers to use.

- Accounting software: I’d also be lost without QuickBooks. I use QuickBooks Simple Start, so it’s fairly affordable (even though it felt like a hefty investment when I was starting out). At $320 per year, it costs more than an Excel spreadsheet but is well worth it for the level of organization (and how professional it makes me look with my clients).

- Desktop computer: I spent the first year or two of my freelance career working on my tiny, slow laptop. I finally sprung for a big iMac after that. Considering how much time I spend hunched in front of a screen, I have zero regrets about getting a fast and reliable computer setup.

As far as where I’m pretty scrappy, I’m not someone who gets swept up in a lot of other software and gadgets. You won’t find me with a fancy ring light for video calls or a ton of specialized software

How do you decide how much to pay yourself versus invest back in the business?

I’m an LLC (not an S-corp), so whatever is left after I cover my expenses is technically mine—to then pay taxes on, of course. Groan.

I don’t have a refined system for deciding how much to invest back in the business. If things are going well, I might be more inclined to spring for a new laptop or sign up for a course or conference. But in recent months, the freelance landscape has felt shakier—plus there’s inflation to contend with—so I’m trying to keep expenses as low as possible.

Plus, since having kids, my own personal expenses are higher (particularly with childcare in the mix). Keeping our first child home during the thick of the pandemic showed me that it’d be impossible to maintain my work over only naptimes and evenings, so consistent childcare was a non-negotiable for us (even with the hefty price tag).

A few more things I’ve found helpful when thinking about investing in my business:

- Plan for taxes first: I have a separate savings account set up specifically for taxes. When my invoice payments roll in, I set aside a large chunk (usually around $16,000/quarter, although I don’t always need the whole amount) before I spend money on anything else. That way I know I’m ready to pay taxes when the due date rolls around.

- Spend intentionally: Especially if I’m facing a larger expense (like a new computer), I’ll plan for it ahead of time. Intentionally setting money aside to cover it makes the purchase hurt a little bit less.

- Log your expenses: My accountant tells me he’s always shocked at how much money business owners leave on the table by not logging their expenses. If you spend money on something for your business, that’s a deduction! Log it and keep the receipt, gosh darnit.

Tell us about your team. At what point did you decide to hire employees or contractors? How do you think about when and who to bring on now?

I don’t have much of a team right now—I’m flyin’ solo! But when I was subcontracting in 2021-ish, I knew it was time to bring more people into the fold because I found myself turning down opportunities I was really excited about.

It wasn’t even really a conscious growth or financial decision for me at the time. It was more that I was getting contacted about projects I’d love to work on, but I just didn’t have the capacity. After talking it through with a few other freelancers who subcontracted, it seemed like a reasonable way to expand my business’ output and say “yes” to more without necessarily burning myself out.

It worked really well for a period of time. But after welcoming my second son in January 2022, I wanted a simpler and more streamlined business. Subcontracting was incredible, but it came with challenges and administrative tasks (onboarding writers, creating briefs and outlines, editing assignments, paying invoices, fielding revisions, etc.).

I realized I felt most “at peace” and in control when it was just me, so I decided to scale back to a solo business—at least for the time being. That’s given me back some more control over my own schedule and workload, since I don’t feel pressure to be signed on and answering questions on days when I otherwise wouldn’t be working. It means I look like I went “backwards” on my balance sheet, but it feels very much like forward progress to me.

What specific strategies or marketing techniques did you employ to attract your first customers or clients? What are some of your most impactful marketing strategies now?

My first clients came through cold emailing and applying through job boards. Those strategies can have a pretty low success rate. But, considering I didn’t have a lot of existing connections or previous work, they were the only viable options. Once I got one or two “yes” responses, things got easier because I started to build up credibility and a portfolio.

These days, my top strategy is to do high-quality, solid work for my clients and deliver it on-time. That’s it. The vast majority of my new clients and projects come through referrals and recommendations.

If and when things are slow, I also find it helpful to reach out to clients and ask for referrals. I’ve landed some incredible projects through existing clients who know somebody else who needs writing help.

I’m fairly active on social media as well. While the bulk of my online presence is geared toward other freelancers, I’ve recently started to share more of my published work and information about my services on LinkedIn. Those posts get a decent amount of traction, and since a lot of my target clients are on LinkedIn, that level of visibility doesn’t hurt.

What’s a turning point that really impacted how you thought about your business or approached growth?

Babies. Kids. Children.

It feels like such a cliché when I say that—like I “mommy tracked” (I loathe that term, by the way) myself in my own business. But there’s a reason that all of the, “kids change your priorities!” sentiments are oft-repeated: they’re true. So dang true.

I had two kids in under two years during a pretty wild time in history (my first was born in April of 2020). And, while the pandemic forced everybody to reevaluate their careers and priorities, I had the added complexity of becoming a mom and feeling this fundamental shift in my identity.

I was always very career-driven. And, while that’s still true to some extent, I now think about what my business can do for me, not what I can do for it. My business is very much a means to earn money and provide for my family, not the center of my self-worth and identity the way it was in the early years.

Today, “success” looks like earning a decent living while still having time and mental energy to dedicate to the things that are far more important to me—like my family, a good book, or an afternoon walk with the dogs. Sure, the year that my business earned the most was financially rewarding, but I was stressed and spread thin. It felt like more of a loss than a gain. After reflecting on that, I realized that “growth” for me meant working less, but on projects I really enjoyed. Now, I work a three-ish-day workweek and stay narrowly focused on the clients that are the best fit for me. I enjoy my business way more now than I did when it brought in $300K.

I think more and more people are feeling that same shift (cue the headlines about “quiet quitting” or “lazy girl jobs”), and I love seeing so many professionals rethink how work fits into their lives—rather than continuing to talk about it like the center of our lives. Regardless of your situation, it’s so important to figure out what “growth” actually means to you instead of getting boxed into thinking it means a steady incline on your balance sheet.

What have been the greatest growth or money challenges you’ve experienced? How have you worked through them?

Without a doubt, getting started was the hardest. It feels embarrassing to say now, but I wasn’t even aware of “content marketing” as a thing when I started my business. I assumed a career as a writer meant writing columns for glossy publications.

I quickly realized those publications weren’t going to respond to me. After landing a gig writing blog posts about storage units for $40 a pop, I had a lightbulb moment: “Oh, companies need content in order to get in front of their customers.” That’s when I pivoted and started focusing on writing SEO content for brands, before eventually finding my niche in the world of work.

But oof, those first couple years were rough financially. My first year (actually a half year), I only brought in $5,300. The next year (2015), I grossed $32,000, which matched what I had been earning full-time. And then in 2016, I found my footing and my niche, bringing in just under $80,000 in gross income, which felt huge.

What are your next growth goals? What do you plan on investing in to help you achieve them?

I know this is when I’m supposed to say I have my eye on some major targets—like spinning my services into an agency and launching more passive income streams. But honestly, none of that is on my radar right now.

My focus is this: Earning a decent income without spreading myself too thin. For me, that means earning somewhere in the range of $8,000 to $10,000 per month while maintaining my three-ish-day workweek, being selective about the projects I take on, and saving plenty of my time, patience, and energy for my family and other interests.

Is that going to make for a super grabby LinkedIn post or headline? Probably not. But it’s where I’m at. I’m looking at growth through the lens of my overall quality of life.

Based on your experience, what advice would you give someone who had a business like yours for growing successfully?

Commit to some trial and error. In business ownership, you want to get everything right immediately. It’s scary to make mistakes or learn tough lessons—it feels like there’s so much on the line.

But honestly, the best lessons are learned the hard way. I wouldn’t have known that subcontracting wasn’t the right fit for me right now if I hadn’t tried it. I wouldn’t have known to prioritize saving for taxes if I hadn’t had one quarterly estimated tax payment sneak up on me.

By all means, consume the advice, ask questions, and learn from others. But don’t let that hold you back from moving forward, experiencing things for yourself, and evolving based on that.

At the end of the day, that’s what growth is, isn’t it?

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.