Connecting Customer Growth and Financial Forecasting for a Clearer View of 2017

Team members

78

Revenue in cash receipts

$993k -3%

MRR

$1.03m +1.17%

ARR

$12.4m +1.6%

Expenses

$916k +14%

After a tricky 2016, we’re headed to a more stable financial position with a bit more visibility on how 2017 will shape up.

We’re also working hard on our skeleton model, as detailed in our previous report, to get better at exploring unit economics.

Also, we’re very excited to report that Ruth Ku has accepted the offer we extended her to become our first VP of Finance, and we’ll be excited to welcome her to the team in January 2017. I look forward to assist Ruth onboard, and build solid foundations for Buffer in the years to come!

How seasonality affects our bottom line

We’ve been thinking quite a bit about the relationship between our business experiments, seasonality and our revenue.

For instance, when we create a plan, such as Buffer for Business, it’s tricky to see how seasonality will affect conversions and churn – and by extension, revenue – before we’ve had the plan for a full year.

Looking at our largest-volume plans (Awesome plans, monthly and yearly – more information on our plans over here), we can get a better sense of how seasonality may affect us.

For instance, we’re anticipating a slower month of December for the Awesome Plan, and have tweaked our cash receipts projections accordingly. We’re expected December to be at best similar to November, and then January should make up for that quiet period.

The difference between cash receipts and accrued revenue

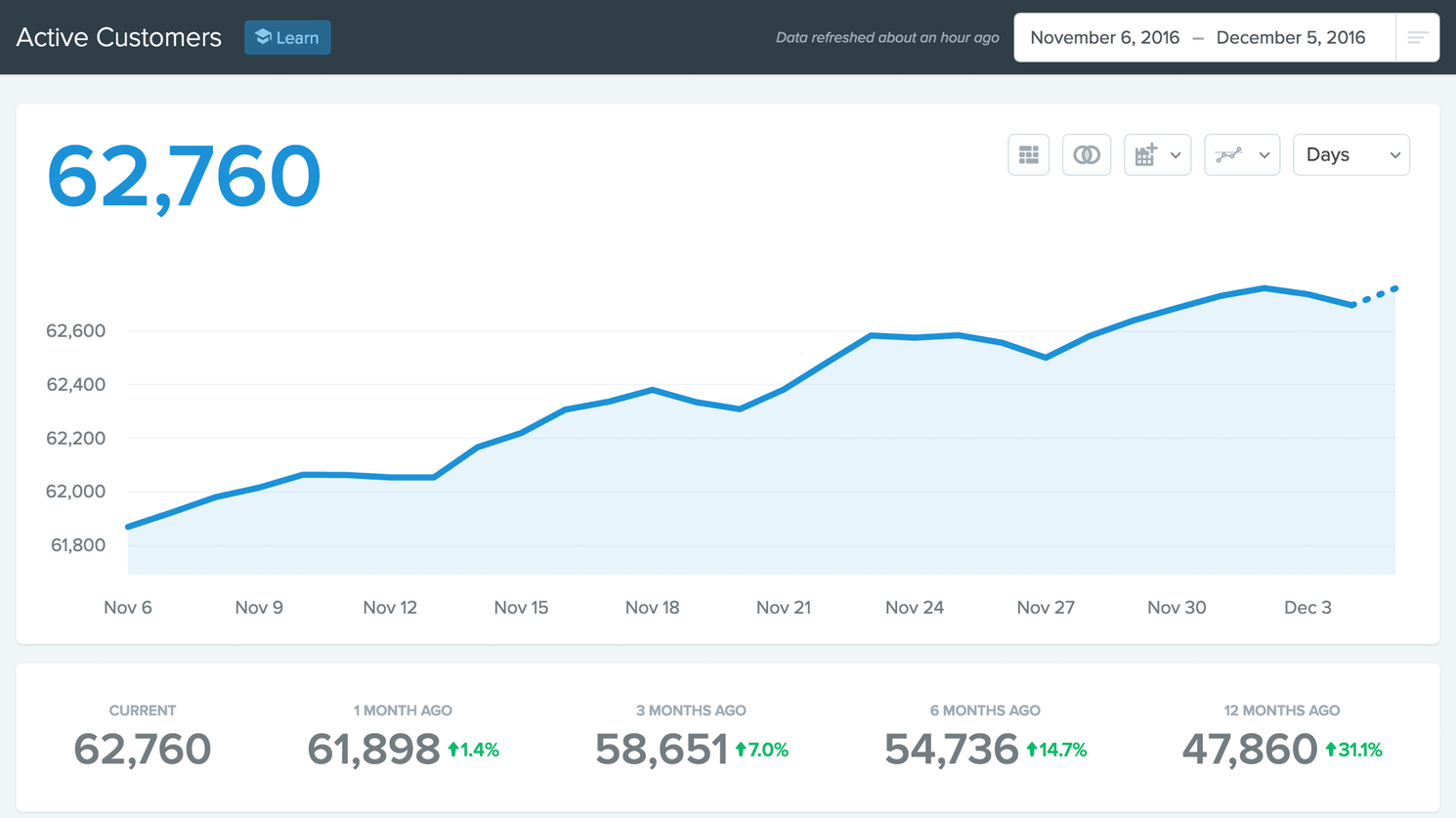

Buffer is a SaaS – Software as a Service business. This means that our 62,687 customers (as of Dec 5th) pay us on a recurring basis using Stripe.

At the end of each financial year – and as we go forward in our journey – it’s interesting to consider the difference between cash receipts and accrued revenue.

- Cash receipts are what is handed to you by your customers at the time of the transaction: If a user decides to sign up to our Buffer Awesome Plan, she can either pay us $10 each month, or pay $102 upfront for a full year. In both instances, we will collect this cash immediately.

- Accrued revenue is the how we tie the money paid by customers to the moment in time where it belongs. Meaning, if our customer paid $102 for a yearly subscription, we’ll get all that money upfront on our bank account. Still, we’ll have to recognize that this $102 is a booking that will be spread over a 12-month period, effectively bringing us – in accrual accounting terms – one twelfth (that is, $102/12) each month: $8.5.

In order to be able to have all our accounts in order, it’s important for us to have data on both our cash receipts and our accrued revenue.

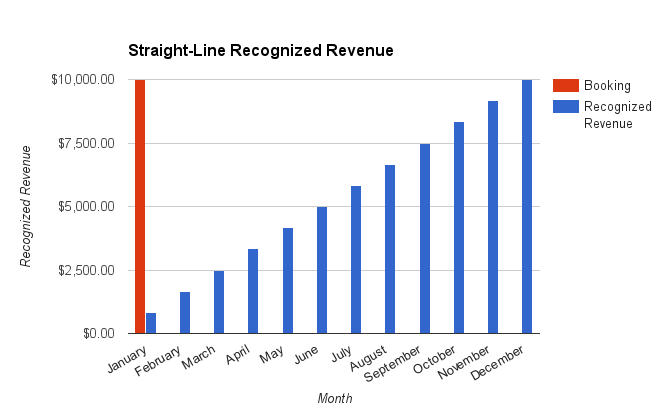

Here is a helpful chart to understand the difference between booking and recognized revenue from a great blog post from Profitwell.

To recognize all revenue, we must take a “cohort” approach, where we need to consider all new subscribers to a yearly plan for a given month, and map revenue forward for the following 12 months. This approach is illustrated on the graph above, and it’s key for us to operate well here so that we can see waterfalls of revenue lined up.

At the end of the year, this is central to understand whether we’ll turn in a profit, or run at a loss. Either situation has interesting tax implications we must consider, in terms of cash flow and business health.

Over to you

Is there anything you’d love to learn more about? Anything we could share more of? We’d love to hear from you in the comments!

Check out more reports from November 2016:

Try Buffer for free

180,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.

Related Articles

Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our ‘default to transparency ’ value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here . It's been quite the y

Editor’s Note: Thanks for checking out this post! We’ve released our updated 2021 pay analysis here. You can’t improve something if you don’t know that it needs to be improved. That was very true for us four years ago when we first started looking into equal pay at Buffer. We have long used a salary formula to determine all of our salaries – the same role in the same part of the world receives the same salary. That m

Ever since the world got turned upside down by COVID-19, it’s been “business as unusual” for everyone – Buffer included. I sent this update out to Buffer’s investors one week ago. I hesitated on whether to share it more widely, as I know a lot of companies have been impacted more severely in these times. That said, I believe it makes sense to lean into our company value of transparency, since there may be some companies this could help, and it shows Buffer customers that we will be around beyon