Tough News: We’ve Made 10 Layoffs. How We Got Here, the Financial Details and How We’re Moving Forward

Founder CEO @ Buffer

The last 3 weeks have been challenging and emotional for everyone at Buffer. We made the hard decision to lay off 10 team members, 11% of the team. I’d like to share the full details of how we got here, and the way we have chosen to handle this situation to put Buffer in a healthier position.

I believe most startup founders are, by nature, optimistic. We want to solve problems and we believe in going from nothing to something. The attitude of most successful founders is that something previously unproven can be made a reality. Most of us have experienced doubt and skepticism and have pushed through it.

Optimism has seen us through a lot of mistakes at Buffer, like the countless new features and products we spent months building only to realize we need to scrap them. Content suggestions and our Daily iOS app are just a couple.

But after a certain point in a company, the mistakes we make don’t just affect the product features. They affect people’s lives.

And no amount of optimism could prepare Buffer for last Monday, when we had to tell 10 talented teammates that their journey with us was over.

It’s the result of the biggest mistake I’ve made in my career so far. Even worse, this wasn’t the result of a market change—it was entirely self-inflicted.

We moved into a house we couldn’t afford

In short, this was all caused by the fact that we grew the team too big, too fast. We thought we were being mindful about balancing the pace of our hiring with our revenue growth. We weren’t.

One of our advisors gave us an apt metaphor for what happened: We moved into a house that we couldn’t afford with our monthly paycheck.

In the past we’ve gotten ourselves out of these situations by growing our revenue faster. We’re optimistic as cofounders, and we believe in Buffer. One such occasion was back in 2013 when our growth slowed slightly and we started to burn cash rather than be cashflow positive. This was when we quickly launched Buffer for Business, and this turned the situation around.

We know that we have many untapped opportunities for growth. This time, however, we simply weren’t able to trigger growth fast enough. We came to the realization that we had to solve the crisis with something tangible and immediate.

The fact is, the challenge that I created has now irrevocably changed people’s lives. I put the company in this position. I had poor judgement and took the wrong actions in many different areas.

Especially at this time, I want to try to live our value of transparency and share everything about the big mistakes we’ve made, the tough changes we’ve decided upon as a result, and where we go from here.

Reflecting on the last year

Over the course of the last year, Buffer went from 34 to 94 people.

We had just come out of a long experiment with self-management, where we fully leaned in to adopting concepts similar to Holacracy, where a company is run with no managers. Ultimately, we decided that we hadn’t been able to make it work. During this period, our team size didn’t change while our customer base kept rising. As we emerged, Leo and I had a long debrief and decided to embrace the ambition we have for the company, and grow significantly in order to serve customers.

Reflecting on it now, I see a lot of ego and pride reflected in that team size number.

Although I know rationally that the size of the team is not something to celebrate, I feel that I slipped into that harmful mindset quite a bit over the last year. Not everyone is familiar with growth metrics like monthly recurring revenue, but team size is easy to understand. Sometimes it impressed people when I told them how big the company was, and I was proud to share it.

Through this experience I’ve learned to re-focus on what truly matters. Our values and mission are so much more valuable than the size of the team. Now I am reminded that working towards our vision and creating great experiences for customers is what matters, and we should strive to do that as efficiently as possible.

It took us quite a while to realize that we had swung the pendulum too far in the opposite direction. We have a bias toward action at Buffer, and believe that moving fast and being bold are important.

It’s also taken most of the last year for Leo and me to understand how to truly work well as cofounders of a growth stage company rather than a startup. The journey we went through to understand each other involved many tough moments, difficult conversations and healthy conflict.

Ever since we grew beyond a small team (around 20 people), Leo and I have arranged ourselves as CEO and COO by splitting the company, and focusing on the areas we felt strongest in. It felt natural and it is how many cofounder pairs choose to run their company. In our respective areas, we were trying to “do it all,” both of us being editors (focused on vision, the why and details) and operators (focused on setting goals, creating results and moving fast).

The previous structure of splitting the company didn’t allow us to dig in as deeply as we needed to in order to spot what was ahead of us.

It took us some time to realize that my strength is as an editor and Leo’s is as an operator. We’re now both working across the whole company, applying our strengths to bring both forward motion and attention to detail.

We’ve made mistakes like this before—lots of them, in fact. But in the earlier days we were mostly building a product. Now we’re building a company, and the calls we make involve people’s lives.

The key mistakes we’ve made

In hindsight, we made some key mistakes with our hiring and costs. The overall theme is that we weren’t attentive enough in using a financial lens on every decision we made.

In greater detail, here are some of the elements that led us to this point:

- Over-aggressive growth choices: In Q4 of 2014 and the first half of 2015, our pace of growth started to slow a little. This is a somewhat natural aspect of a reaching higher levels of revenue—it’s hard to keep growing a larger number at the same pace you once were able to. We were in a healthy financial position and chose to put our foot on the gas. In hindsight, Leo and I were too aggressive with that change and would have put Buffer in a better position if we had gradually increased our pace, rather than triggering such drastic growth efforts.

- Lack of accountability: In a 10-person company, everyone wears many hats. In a 500-person company, almost everyone is specialized and decision makers are clear. What’s often not talked about is the transition from generalists to specialists. That transition has been messy at Buffer. Especially in areas we know less about, like finance and HR, we haven’t brought on board experts soon enough. As a result, some things have fallen through the cracks and we’ve gotten a lot wrong.

- Trust in our financial model: We’ve made several changes to our forecasting models recently that have shown us some areas are weak. We now realize our models are quite imperfect. We have a lot of work to do to get to a place where we can truly trust that we have all the correct information needed to make good decisions.

- Explicit risk appetite: We previously had never established what a “healthy bank balance” was, nor whether Buffer had to be profitable or could burn a bit of cash. Once we made the decision to work back towards profitability, we began to understand the depth of our situation.

- Over-enthusiastic hiring: In many areas, we grew the team more than was truly necessary for the time, more than was clearly validated. We hired a full customer success team in anticipation for going more up-market, which we then didn’t move on quickly enough from a product perspective.

- Team restructuring: We restructured our product teams, choosing to have product managers go deeper in product disciplines such as tech, user experience and data analysis. This shift back to embracing more generalization meant that we didn’t need as many specialists.

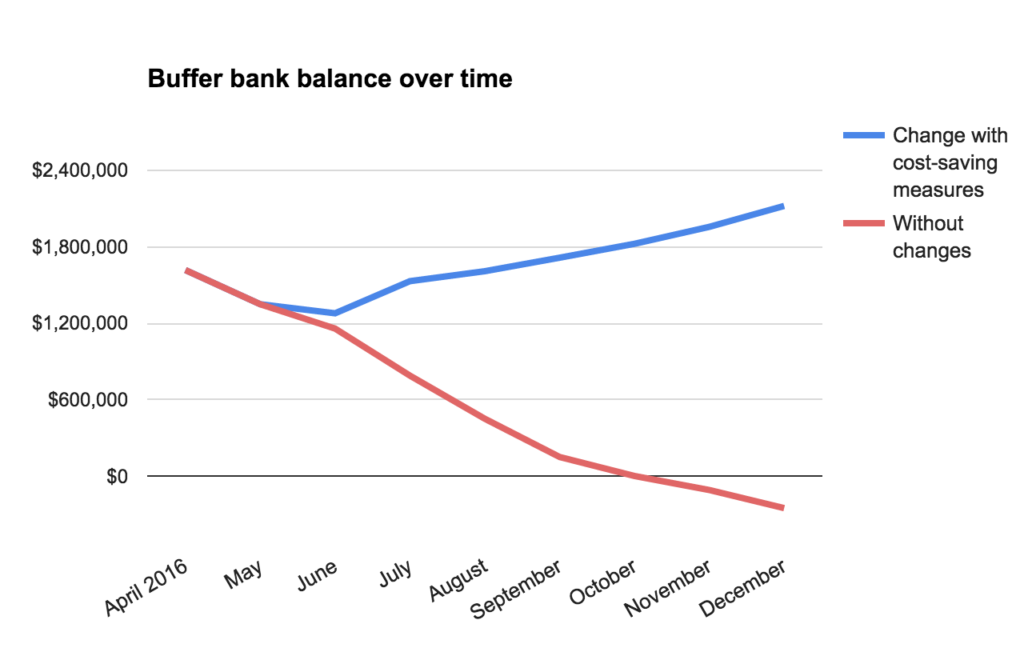

The result of these mistakes and getting full clarity on our financial situation was that despite having $1.3m in the bank, we were rapidly trending towards zero cash within 5 months.

The changes we’ve made to recover

With our spending exceeding our revenue, we knew we needed to make some changes now to avoid an even bigger problem down the line.

We explored many scenarios to move forward. In the end, these are the cost-saving measures we decided to take in order to recover:

- We made 10 layoffs in order to recover to a healthier financial position. Savings: $585,000

- Both Leo and I have taken a salary cut of 40% until at least the end of the year. Savings: $94,000.

- Leo and I are committing $100k each in the form of a loan at the lowest possible interest rate, with repayment only when Buffer reaches a healthy financial position. Savings: $200,000.

- We adjusted the loyalty portion of our salary formula. Each teammate previously got a salary bump of 5% on their year anniversary with Buffer. Now it’s 3%, applied for everyone who has been with the company longer than a year. Savings: $74,000.

- We’ve discontinued two perks (with the hopes of bringing them back in 2017, if we are able):

- A health & wellness grant of up to $100 per teammate per month. Savings: $49,000.

- An annual vacation bonus of $1,000 per teammate and $500 per dependent. Savings: $52,000.

- We canceled our upcoming team retreat to Berlin. Savings: $400,000.

- We cut our sponsorship budget through the end of the year. Savings: $75,000.

The toughest change: We made layoffs and said goodbye to 10 teammates

I wanted to share more about the tough decision to make 10 layoffs in order to recover to a healthier financial position.

Leo and I deliberated in 5-hour meetings each day for days on end with the other members of our executive team, Carolyn and Sunil, as we called in advisors and counsel to help us understand the best way to make these tough choices.

No matter how much we deliberated and how much we thought about it, the gradual and terrible realization we came to was that it came down to people.

Salaries are more than 80% of our expenses, and we would have to impact team members to get back on track.

The layoffs we made equal savings through the end of the year of $585,000, or an extra $100k in the bank every month. This is a crucial amount to help us steer clear of further financial troubles.

These 10 people have all done stellar work for Buffer. With our culture of bringing our whole selves to work and seeing team as family, with shared values we live by, this process has been especially difficult. Many team members are close friends with those whom we said goodbye to last week.

These were not performance-based changes. Instead, we found roles that we felt we could remove entirely, and other roles where we could operate with fewer people.

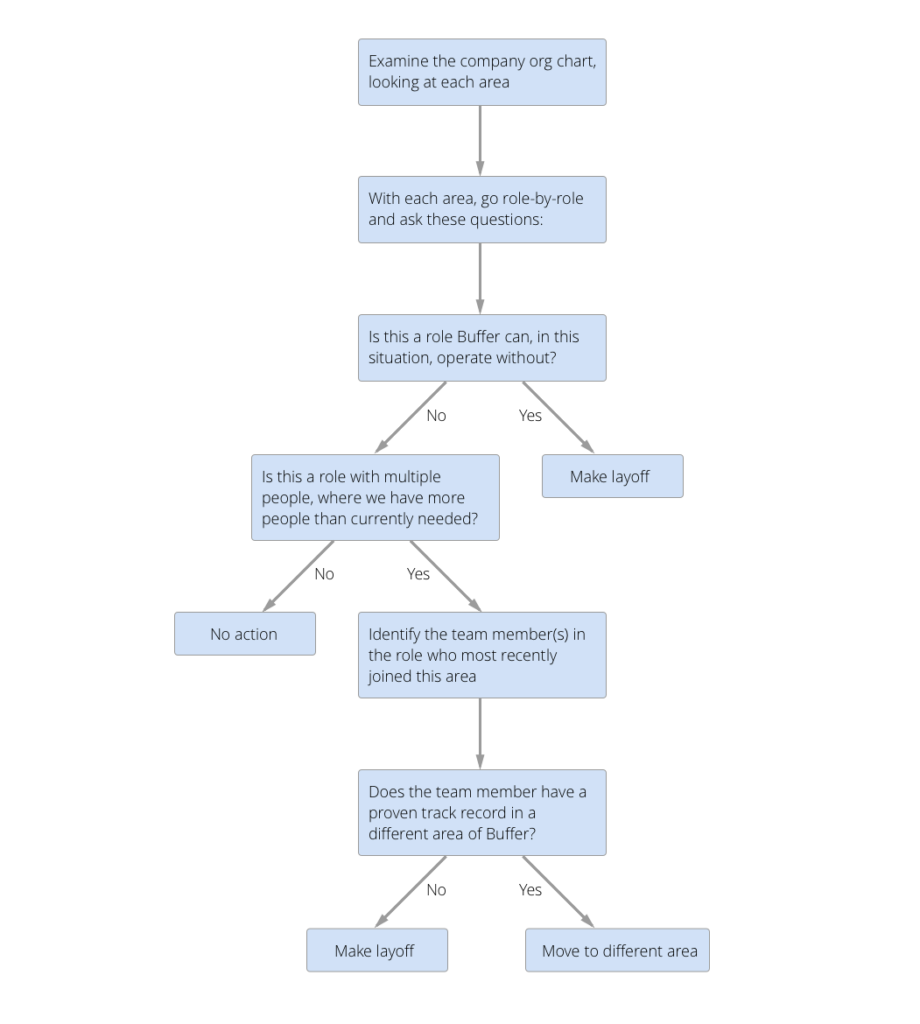

We used a specific methodology that centered on a “last in, first out” approach in order to avoid any bias in selecting individual teammates.

We’re planning to do everything in our power to help these awesome people on the next step of their journey, including 3–6 weeks severance based on time spent with Buffer, 3 months of full healthcare coverage, and recommendations and introductions to other companies.

Our present financial state and future goals

Altogether, these changes bring us to a total savings of $1.5M through year end.

With the cuts we’ve made, the projection for our bank balance from June through December 2016 changes dramatically and puts us in a position to make a full recovery.

We are excited to return to profitability, and I’m confident about the path we’re on now. Our bank balance is currently $1.3M, and this will help us grow it back to $2.1M by January 2017.

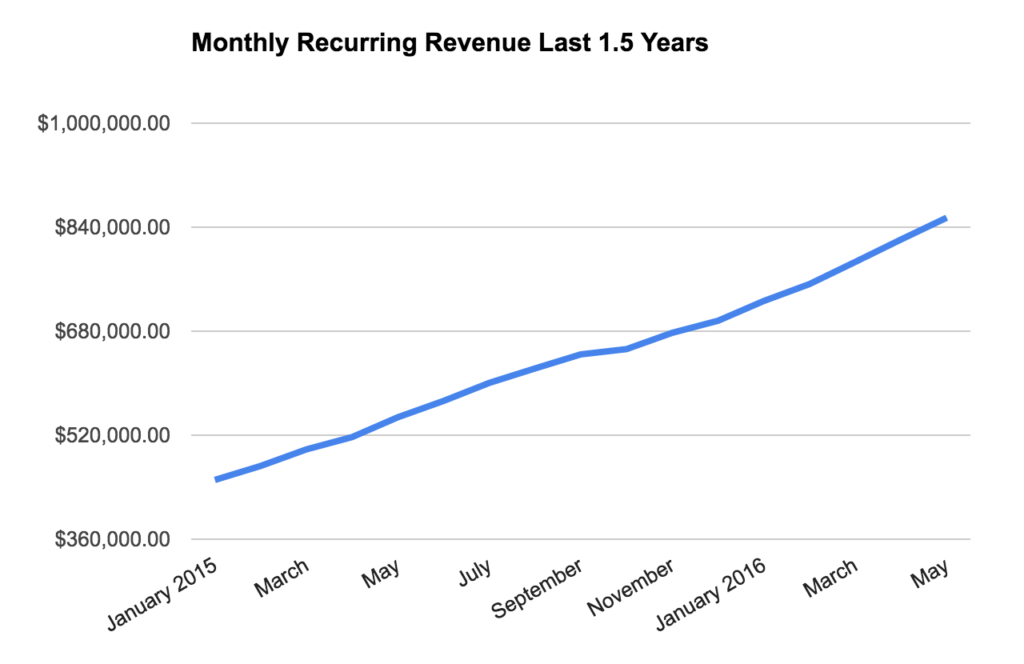

While these changes are hard, this isn’t a slow-down. This is an execution mistake and isn’t related to market changes or loss of revenue stream.

Our revenue continues to grow consistently, and at the time of this writing we’ve crossed $875k in monthly recurring revenue: $10.5 million annual recurring revenue.

I feel that repairing the mistakes we’ve made will position us to be leaner, stronger and focused on the right areas going forward.

Part of the learnings we’ve had and advice we’ve received here has been around what a healthy bank balance looks like as a company reaches new stages of growth. The overall consensus we’ve observed is that it is healthy for a company to have 5–6 months of expenses in the bank. Another approach Jason Lemkin shared with me is to aim for 50% of annual recurring revenue in the bank:

@joelgascoigne i think @dfjjosh‘s rule of 50% of ARR to operate and invest without $$$ stress is a really good one. use debt to hack it.

— Jason M. Lemkin (@jasonlk) April 17, 2016

With this experience, we’re now committing to moving towards this ideal. For us in our current situation, this means moving towards $4–5 million in the bank. We’re aiming to return to profitability and work towards reaching this goal mid-2017. We may look at venture debt as a way to help grow the bank balance, while still remaining profitable.

Why we’re choosing minimal fundraising and profitability over the traditional Silicon Valley path

In many ways, we chose this path and put ourselves in this position. It’s been entirely our decision to operate primarily based on cash flow and profitability rather than fundraising.

We know other companies who have similar cash flow situations to us but have raised $20–30 million in funding. These companies, which are the more normal path in Silicon Valley, have chosen to operate in a way where they have a high burn rate resulting in a limited “runway” between each fundraising. Generally startups aim for 12–18 months runway from a round of funding.

The traditional fundraising path has deliberately not been the way we have chosen to operate, and so in situations like this we choose not to use fundraising to solve the challenge. We view fundraising in a different way, more of an enabler than something we want to be fully reliant upon.

This has some implications on the true growth rate we can expect, yet it has significant benefits we feel in terms of the freedom we have to experiment not only with innovation in products but also in the way we work.

This way of operating feels integral to our vision and culture, yet it is also what has put us in this crisis.

We chose not to raise funding to solve this where other companies might have. We expect further fundraising to be in our future, however we would like the company to be completely healthy from a financial standpoint, so that we can raise funding on terms we feel fully happy about, and so that we can always walk away if we feel that is better for Buffer.

Although this is a difficult situation to be in, in many ways it is still a proactive correction. We would rather uncover these cash flow issues early and work through them now. Tens of millions in the bank could have masked this problem.

What does this change for the team?

I can already identify a lot of things I would have done differently in sharing this tough news.

Now that our team is quite a bit larger, we struggled with how much of this to burden them with when they couldn’t take any action to change things. I don’t feel that we fully lived up to our value of transparency, specifically to share early in order to avoid a big revelation later.

As a result, our team was understandably surprised by the changes we’ve made, especially the loss of teammates and friends.

There’ve been lots of questions and plenty of healthy discussion around feelings of guilt, sadness and fear. We want everyone to keep reflecting and communicating as much as they need.

While we heal and recover, we want to focus on getting back to a financially healthy position and making Buffer a sustainable business in the long run. This means a closer lens of finance on everything we do. Additionally, we want to challenge ourselves to improve in these specific areas:

- Adding to our finance/accounting team: We plan to grow our finance team with the addition of someone quite senior who can help us understand all that we don’t know and get us to solid financial footing.

- Catching up on housekeeping: We’ve got some internal auditing to do to make sure our processes have grown along with our team, and there’s quite a bit of legal/accounting catch-up to be done.

- More financial oversight for teammates: So far in our journey, we’ve tried to stay lean as far as internal process and rely on the advice process for decision making. At our current, larger size, it might be time to remove the burden of the money part of things from teammates by providing more explicit oversight. For example, checking with Finance before spending more than $500.

- Next retreat in early 2017: Retreats are such an important element of our distributed team, and it’s disappointing to have to cancel our upcoming opportunity to be together. We are, however, still planning on a team retreat in early 2017. This has been fully budgeted for in our recovery plan. Meanwhile, we’re exploring adjusting our retreat approach by reducing the frequency of the whole-company retreat, and complementing that with smaller team- and area-based retreats. We’re looking at these changes with a disciplined financial lens.

Thank you to the community for your support

Throughout this tough time for Buffer, I’ve been truly blown away by how supportive the startup community is.

We’ve worked through this with advice with help from so many advisors and friends of Buffer. I owe a debt of gratitude to Kanyi and Craig from Collaborative Fund, Dharmesh from Hubspot, Gokul from Square, Steven from A16Z, Hiten from KISSMetrics, Ryan from Product Hunt, and Danielle from Mattermark.

Their advice has been invaluable to us throughout this process and reminds me again how lucky we are to have a strong community we’re able to ask for help.

It’s our privilege to learn from our advisors, friends and community every step of the way as we share our journey – the highs as well as the lows. Right now more than ever, I’m keen to keep sharing and learning.

I’d love for you to hold us to a high standard, ask us the hard questions and hold us accountable to keep improving and sharing.

What’s next for Buffer

I’m truly sorry for the disappointment and anxiety I’ve caused, and for creating this difficult situation for the team. I personally feel this is a big mistake for me to make as CEO, and I take full responsibility.

I’m confident that we’re taking the steps we need to recover from this as quickly as we can and get back to a financially healthy position.

Our goal is to achieve $20M annual recurring revenue over the next 12-18 months, and we are doing everything to do so sustainably and with the right team.

While we make changes internally, we’re working hard on improvements to the Buffer platform, including launching Buffer for Instagram and many more new features.

Growing to well over 50,000 paying customers, I believe more than ever that Buffer has a clear role to play in bringing about the change we wish to see in the world: to give businesses and individuals a greater voice for the good they’re doing, and to do it while innovating around company culture and striving to inspire others to have joyful workplaces.

I’m in this for the long haul, and I’m excited to transform this mistake into a big learning moment to help us continue our journey.

I know there might be a lot of questions and thoughts following this news, and I want to honor that. Please share anything that you’re feeling—we’re listening. Drop us a note in the comments and myself or someone else in the team will get back to you quickly.

Try Buffer for free

180,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.

Related Articles

We've been hosting Retreats at Buffer for 12+ years. In this article, we've detailed everything we've learned from 14 Retreats.

I recently attended my first in-person, international conference. Here's what I learned.

What it was like to join a fully remote team like Buffer, and how going on the company retreat so early on helped shape my journey in ways I hadn’t imagined.