In August, we had our best MRR numbers of 2016 and wrapped up our first “Buffercelerator” project. Here are the highlights:

MRR: $947.7k

ARR: $11.4m

MoM: 4.7% from July

Note: We adjusted our calculation of MRR as we discovered we were overreporting our MRR by around $20k, which was due to the portion of MRR coming from Apple in-app subscriptions. We’ve now corrected this, and so if you were to compare our revenue growth to last month, this would be why the MoM% seems slightly off. We have recalculated previous months and the 4.7% MoM number correctly reflects our growth from last month.

Further metrics

- 59,501 paying customers (+2.7%)

- 264,275 MAU (+3.6%)

- 161,488 WAU (+1.38%)

- $1.49m in the bank (+15.5%)

- 81 team members across the world (+1)

Our first Buffercelerator experiment

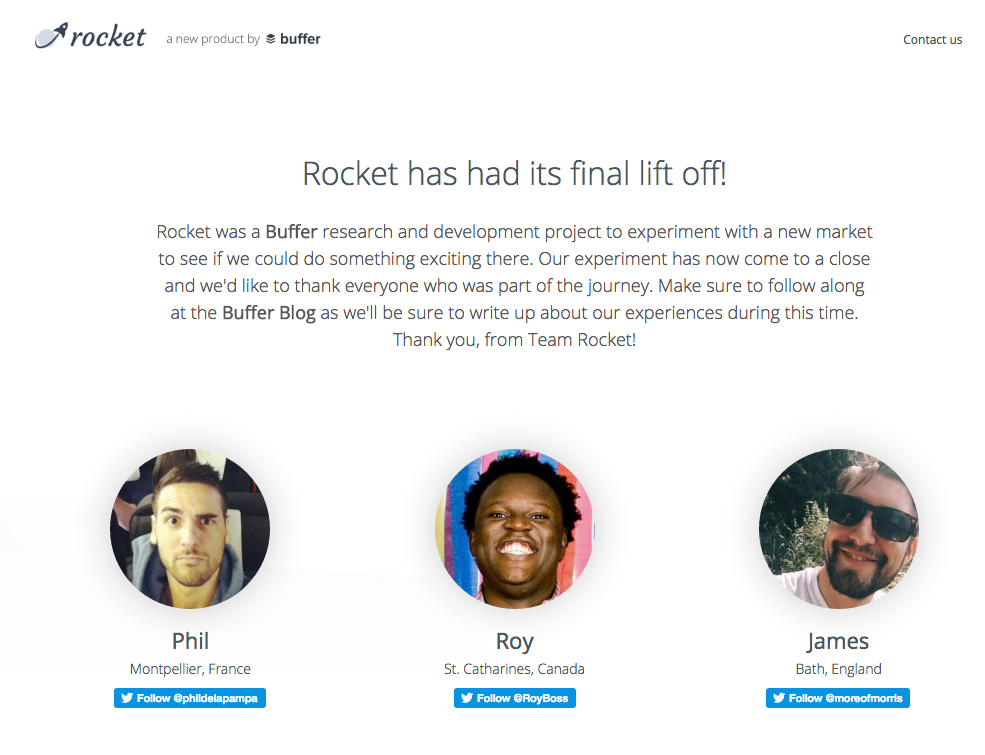

In August we brought to a close our first “Buffercelerator” experiment, in which a small team spent 9 weeks creating a new product with a goal of reaching product/market fit.

A great team developed Rocket, a tool to help you visualize performance of Facebook Ads.

Ultimately, the new product won’t continue. However, this is far from a failure – it’s been quite an incredible journey. The team accomplished a huge amount in 9 weeks, and said it was the most learning they’ve had their whole career.

We’re keen to do more Buffercelerator projects in the future, creating an environment where you choose your team and show you’re ready for early-stage startup pressure.

We also want to add a component of reward and give people significant equity or upside in the new venture. Instead of salary, we’ll give “funding.”

Ultimately, Rocket team chose to rejoin the Buffer team. This is the best outcome, as we’re still recovering our bank balance to a healthy level.

Overall, the cost for this experiment was minimal – around $50k (3 peoples’ salary over 9 weeks). The potential upside was huge, as were the lessons we learned. Although we may not have another project soon, I’m excited to eventually try another round of the Buffercelerator!

Best MRR of the year

With an MRR of $947.7 for the month of August, we’re up 4.7% from July and seeing the best metrics of 2016.

MRR from trial conversions in particular increased by quite a bit, especially from Awesome Plan trials.

This is great validation that the work our growth team is doing is having a big effect. In their August report, the team shares the full details of a recent experiment that automatically puts new Buffer customers on an Awesome trial.

Here’s their hypothesis: “We believe that when a customer is offered unrestricted access to the Awesome plan immediately, they are more likely to experience the value of paid features and are therefore more likely to upgrade at the end.”

As a result of this experiment:

- 24,500 customers started an Awesome trial in August (compared to a monthly average of 3,100 for the past 6 months)

- 1,078 of them converted to a paid plan (compared to a monthly average of 490 for the past 6 months).

We’ll keep monitoring this experiment to make sure it’s a great experience for our customers, but these results are exciting!

Jump in profit

July was our first cashflow positive month of 2016 and we continued that positive trend in August with $149k in profit this month –+122.3% from July!

Since our cashflow crisis, we’ve been diligent about staying on top of our finances, scrutinizing our needs and cutting back where we can.

As a result, we’re cashflow positive for the second month running and feeling good about our financial future.

Our ultimate goal is to have 3.5 months of expenses on hand, and we’re getting closer every month. We’re on track to be more than 50% to the goal by the end of the year.

Still seeking a finance leader

Just a quick note that we’re still seeking a finance director to help hone Buffer’s financial models, lead our finance team, and have a big impact on Buffer’s future direction.

My ask for you this month: Would you be up for sharing our job listing with 2 contacts? We’d love to cast a wide net and chat with many qualified candidates, especially candidates from underrepresented groups, and this would be so helpful to get the word out!

Thanks so much for your support!

– Joel Gascoigne

Check out more reports from August 2016:

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.