Here is a first for a report we’ve never done before. We started publishing our Buffer for Business metrics for a few months now, however we’ve not done this for the Buffer Awesome Plan (our $10/mo, more consumer focused pricing plan).

This is by far also still making up the biggest chunk of our monthly revenues, at roughly 76% coming from the Awesome plan.

Here is a breakdown of how it performed this month:

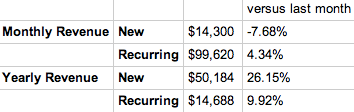

Revenue

Total Buffer revenue in December = $235,000

Revenue from Awesome in December = $178,792

Revenue from Business (More about Buffer for Business Dec 2013) = $56,208

Paying Users

- Total Paying Users is 16,401, +6.0% from November.

- Total new customers is 1922, -1% from November.

(Note: Part of this we started tracking half-way through December, so some of the data is incomplete here)

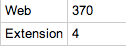

Platform ( Where do they come from ):

(Note: The same as above applies, the original sign-up sources for Awesome plan suers isn’t quite complete)

Conversions

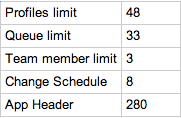

Number of upgrade to Awesome plan in December / people hit the prompt to upgrade

## We are starting to track the people who hit the prompt to upgrade this month

Growth

- 2.7% increase in MRR (from 111,000 to 113,900)

- 2.3% increase in Total awesome revenue (from 173,750 to 177,792)

- 0.9% decrease in Total new awesome users (from 1,939 to 1,922)

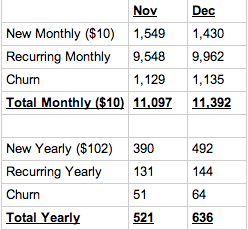

Total paying users & Churn

Total

Total:

Awesome ($10/mo) x 11074 (+Paypal)

Awesome Yearly ($102/mo) x 1233

Outlook, observations, thoughts

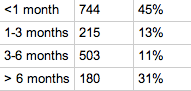

26% of our Awesome upgrades in December are on annual plan, versus an average of 19% in the past 6 months. While growth of paying users were almost flat in December, we managed to grow the Awesome revenue by 2.7% by encouraging more users to go on the annual plan. We will pay more attention to the churn rate of annual users in the coming months.

Many upgrade from just the dashboard:

- That invalidated a previous finding, which showed that users needed to hit limits first before upgrading. This data, however, suggested that free users explore to upgrade from the web dashboard, without getting prompted.

- An experiment idea can be to email all active free users who do not meet the requirement for awesome yet, and tell them to upgrade to awesome.

- 45% of the users who upgraded to Awesome, signed up to Buffer less than 1 month

Further insights that can be interesting:

- Where the awesome users signed up from Buffer originally.

- By mapping out the entire funnel, we can learn more about the user acquisition channels that leads to most revenue, and double down on those.

We’re definitely seeing slower growth on the Awesome plan, compared to the Business plans, so it’ll be good to try a few experiments to help Awesome revenues to grow in similar fashion.

We’d love to answer any questions on the above report or any other thoughts about how we’re doing things at Buffer.

Try Buffer for free

180,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.

Related Articles

Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our ‘default to transparency ’ value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here . It's been quite the y

Editor’s Note: Thanks for checking out this post! We’ve released our updated 2021 pay analysis here. You can’t improve something if you don’t know that it needs to be improved. That was very true for us four years ago when we first started looking into equal pay at Buffer. We have long used a salary formula to determine all of our salaries – the same role in the same part of the world receives the same salary. That m

Ever since the world got turned upside down by COVID-19, it’s been “business as unusual” for everyone – Buffer included. I sent this update out to Buffer’s investors one week ago. I hesitated on whether to share it more widely, as I know a lot of companies have been impacted more severely in these times. That said, I believe it makes sense to lean into our company value of transparency, since there may be some companies this could help, and it shows Buffer customers that we will be around beyon