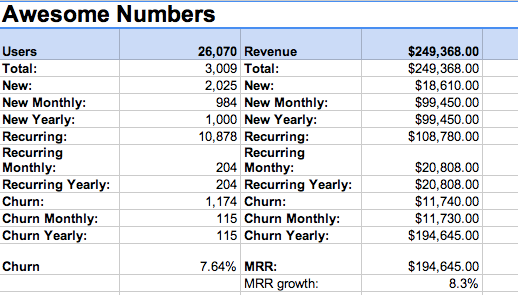

April has been a very interesting month. MRR growth has slowed to around 7.08% increase, which is the lowest over the past few months.

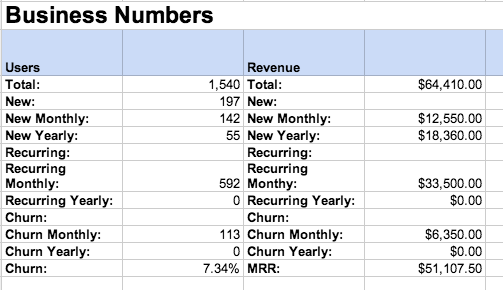

What’s interesting is that most of the growth came from Business plans, which grew MRR by 15.6% in April. Awesome plan MRR growth slowed to 4.6% in March, and was 8.3% in the month before.

At the same time, churn has decreased by almost 2 percentage points to 5.28% on the Awesome plan (compared to 7% in March) and also to 5.99% on Business plans.

Awesome numbers for April

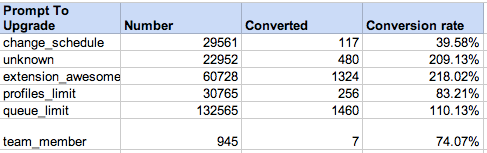

Where do upgrades come from?

Business numbers for April

Here is the full data:

More work on the growth dashboard

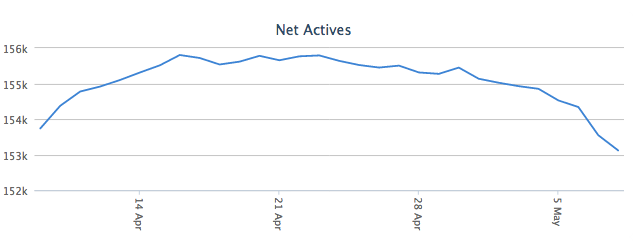

We’ve started to make a big step forward in building out our own growth dashboard by building the “user accounting” dashboard. We are now much more closely focused on tracking actual net actives, instead of signups or other metrics.

We’ve also started to look at more historical data (after a small shock whether all our numbers are going in the wrong direction) and things are looking much healthier on a 6-12 months scale, which is encouraging. At the same time, we want to make significant changes to improve all numbers.

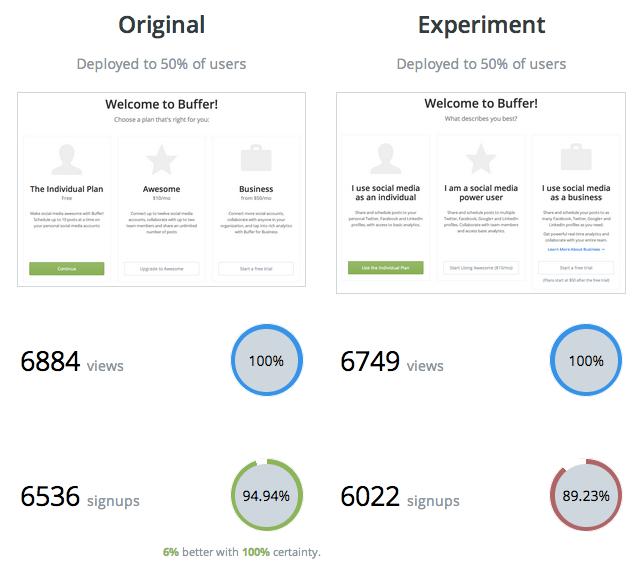

Steven has also done great work in collaboration with Joel to build out the experiments dashboard. The goal here was to make significant improvements to how we’re tracking the success of our experiments and avoid having to query the results manually every time:

Interesting facts and takeaways for May

Over 11,000 trials were started, but only 177 users converted to paying customers. A key learning from Brian was that most customers find Buffer for Business “too expensive,” which can probably directly be translated to “it doesn’t have (show) enough value.” We are going to focus on 2 key areas in May to improve the conversion rate here:

- Teach value better (How can we show more Buffer trialists the value of Buffer for Business)

- Provide more value (We’re going to double down on key features like reporting, content suggestions, feeds, etc.)

The new monthly MRR contribution from Awesome is $16,640, compared to $12,150 from Business. Business has started to be 75% of new monthly MRR of Awesome. (Side note: Since we default to “Yearly” for Awesome users, this metric might be quite a bit skewed.)

With the new experiments dashboard, our goal is to improve the weekly experiments that are running at any given time and get more small wins across multiple experiments.

Improving measurement of “activation”: Currently, if a user posts one update, we count them as having “activated;” however this isn’t the most meaningful metric. A key goal for May is to come up with a more representative metric around activation.

Over to you

I’d love to hear any thoughts or questions you might have about these numbers. It’s awesome to be able to share these publicly each month, and we really value the feedback we receive. Ask away in the comments!

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.