June Financial Report: Our Highest Growth of 2016, Recovering From Cashflow Crisis

Last month we published the toughest news Buffer has ever shared—that a cashflow crisis caused by hiring too quickly forced us to make the hard decision to say goodbye to 10 teammates.

Since we shared that news, we’ve been working to make many financial, accounting, and organizational changes and transitions needed to become stronger and more financially sound.

We’re also actively searching for a finance director who can help us build a strong foundation and look toward the future with confidence.

Meanwhile, we wanted to share an update with you. Let’s look back to June and see how we did:

Expenses: We spent $1.05m

On the expense side, we spent $1.05m (-10.97%). The decrease in total expenses is a result of the layoffs we made following our cashflow crisis. However, because of severance pay, the full related decrease in salary costs does not factor in until July.

Our top expenses were:

* Payroll: $762k

** Hosting: $120k

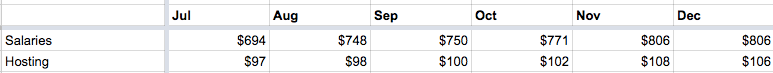

*This is a forecast of our future salaries and hosting expenses. Salaries are based on a hiring plan that’s currently under review, so we might change some things here to keep these costs under control.

**Modest growth based on regular monthly expenses. We don’t have any plans for large purchases (like reserved instances) for the remainder of the year.

Revenue: Highest growth of 2016

Expenses are just one side of the coin. Revenue growth is equally important to sustain our expenses and increase our bank balance.

Happily, we reported our highest month-over-month growth of 2016 in June. We’re excited to have ramped up the number of growth experiments we’re performing, which we believe impacted this number.

- The month ended with $897k (+4.85%) monthly recurring revenue, our highest month-over-month growth this year.

- This gave us a total of $10.76m annual recurring revenue.

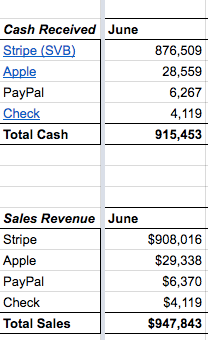

- Our total net revenue was $915m (+1.81%). Here’s a breakdown of what those different revenue sources looked like:

Overall: $133k loss; $1.22M in the bank

Altogether, this gave us a $133k loss for June. We’re trying to operate as close to profitability as possible, so there’s a lot of room for improvement here. We’re currently reviewing expenses to see what we can change to get closer to these goals. Most tweaks that are being considered are around hiring costs (recruitment fees), a slower pace of hiring, and savings on subscriptions.

Our bank balance at the end of this month was $1.22M (-9.51%) which is a step backward from our goal to be around $1.75M at the end of 2016, and $3.5M at the end of 2017.

Over to you

It’s so important to all of us at Buffer to be accountable to you, our customers and community, in everything we do. If there is additional information you’d like to see in this financial report, please let me know and we’ll do everything we can to include it in future updates!

Special thanks to Karim Osman for gathering all of this great information!

Try Buffer for free

180,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.

Related Articles

Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our ‘default to transparency ’ value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here . It's been quite the y

Editor’s Note: Thanks for checking out this post! We’ve released our updated 2021 pay analysis here. You can’t improve something if you don’t know that it needs to be improved. That was very true for us four years ago when we first started looking into equal pay at Buffer. We have long used a salary formula to determine all of our salaries – the same role in the same part of the world receives the same salary. That m

Ever since the world got turned upside down by COVID-19, it’s been “business as unusual” for everyone – Buffer included. I sent this update out to Buffer’s investors one week ago. I hesitated on whether to share it more widely, as I know a lot of companies have been impacted more severely in these times. That said, I believe it makes sense to lean into our company value of transparency, since there may be some companies this could help, and it shows Buffer customers that we will be around beyon