Last month we published the toughest news Buffer has ever shared—that a cashflow crisis caused by hiring too quickly forced us to make the hard decision to say goodbye to 10 teammates.

Since we shared that news, we’ve been working to make many financial, accounting, and organizational changes and transitions needed to become stronger and more financially sound.

We’re also actively searching for a finance director who can help us build a strong foundation and look toward the future with confidence.

Meanwhile, we wanted to share an update with you. Let’s look back to June and see how we did:

Expenses: We spent $1.05m

On the expense side, we spent $1.05m (-10.97%). The decrease in total expenses is a result of the layoffs we made following our cashflow crisis. However, because of severance pay, the full related decrease in salary costs does not factor in until July.

Our top expenses were:

* Payroll: $762k

** Hosting: $120k

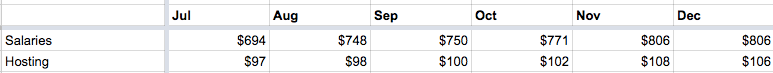

*This is a forecast of our future salaries and hosting expenses. Salaries are based on a hiring plan that’s currently under review, so we might change some things here to keep these costs under control.

**Modest growth based on regular monthly expenses. We don’t have any plans for large purchases (like reserved instances) for the remainder of the year.

Revenue: Highest growth of 2016

Expenses are just one side of the coin. Revenue growth is equally important to sustain our expenses and increase our bank balance.

Happily, we reported our highest month-over-month growth of 2016 in June. We’re excited to have ramped up the number of growth experiments we’re performing, which we believe impacted this number.

- The month ended with $897k (+4.85%) monthly recurring revenue, our highest month-over-month growth this year.

- This gave us a total of $10.76m annual recurring revenue.

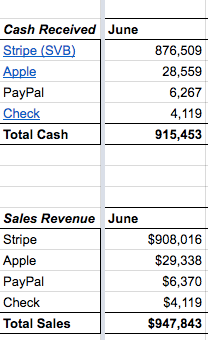

- Our total net revenue was $915m (+1.81%). Here’s a breakdown of what those different revenue sources looked like:

Overall: $133k loss; $1.22M in the bank

Altogether, this gave us a $133k loss for June. We’re trying to operate as close to profitability as possible, so there’s a lot of room for improvement here. We’re currently reviewing expenses to see what we can change to get closer to these goals. Most tweaks that are being considered are around hiring costs (recruitment fees), a slower pace of hiring, and savings on subscriptions.

Our bank balance at the end of this month was $1.22M (-9.51%) which is a step backward from our goal to be around $1.75M at the end of 2016, and $3.5M at the end of 2017.

Over to you

It’s so important to all of us at Buffer to be accountable to you, our customers and community, in everything we do. If there is additional information you’d like to see in this financial report, please let me know and we’ll do everything we can to include it in future updates!

Special thanks to Karim Osman for gathering all of this great information!

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.