A while back Danielle Morill asked this question on Twitter:

How many startups provide a spreadsheet explaining exactly what would happen to your options given several possible outcomes for the company

— Danielle Morrill (@DanielleMorrill) May 13, 2015Explaining equity is something we try to do as best as we can at Buffer, which Joel shared in his reply.

A big learning we’ve had as we’ve added team members is that understanding stock options and putting them into context is not very easy.

We thought that sharing transparently how we approach things at Buffer might possibly help other companies explain all the options to new people joining the team.

Here’s the equity email we send to new team members

When a new teammate joins the Buffer team and successfully completes their Buffer bootcamp, they have a decision to make: either pick a $10,000 higher salary or a 30% higher equity offer.

Disclaimer: We are in the middle of rethinking how our salary and equity formula works. Now that we’ve hit 50 people and the general stock options package has decreased, the $10k vs 30% options increase isn’t as viable as it was before. The general way we display stock options is hopefully still useful!

We’ve had many iterations of how we explain what stock options mean in our offer email, and this is our current phrasing. Here is the exact email we send to new teammates, in full (Note: These are the numbers for Rodolphe, just as an example. We fill in the salary and equity blanks for each teammate using our salary formula and equity formula):

I wanted to take a moment to send along some information that might help with your salary/equity choice.

There’s a lot of information here so I’d like to mention right away that there’s absolutely no rush on this at all! Please feel free to take as much time as you need to talk with the people in your life and get all the context you need to feel really comfortable with your decision.

Here, you essentially have two options, one is lower salary and higher equity, and the other is higher salary and lower equity.

Option 1:

Lower salary: $88k/year

higher equity: 0.254% = 28,591 options

(What does 28,591 options mean in actual $?

Buffer is re-valued every year and after certain fundraising rounds (we just raised one in August 2014). This re-value would be what’s called your ‘strike price’ and it would be deduced from your gains on some sort of liquidity event (acquisition/sale, IPO or future investment raise). For these examples below, I’ll assume we are valued at $0.799 a share. We try to keep this low when possible.

We recently raised money valued at 60 million USD. We wouldn’t likely consider selling Buffer for anything less than 100 million. So I’d love to give some scenarios to help translate this to real money. Lets say Buffer sells for $100m USD, which means each share is 7.94 dollars – you would get: 28591 * 7.94 – (28591 * 0.799) which is $204.743.22 USD. We’ve recently turned down an offer of over 100 million USD, so it’s likely we wouldn’t sell for anything under this amount. Our opinion is as long as things are going well and we’re having fun we want to see this grow as much as we can.)

If Buffer sells for $100m – you get $204.743.22

If Buffer sells for $200m – you get $409,486.44

If Buffer sells for $600m – you get $1,228,459.33

Option 2:

Higher salary: $98k/year

lower equity: 0.195% = 21,950 options

If Buffer sells for $100m – you get $157,184.76 (~ $48k less than higher equity)

If Buffer sells for $200m – you get $314,369.51 (~ $95k less than higher equity)

If Buffer sells for $600m – you get $943,108.54 (~ $285k less than higher equity)

The number of shares issued in our pool is: 12,587,538

Explaining the details: Vesting, dilution and more

The email goes on to explain many more details beyond just the numbers to consider—things like how often we plan to raise money, what sort of risk is involved in choosing equity over salary, and how vesting works.

Again, this is from the exact email we send to new Buffer teammates:

One thing we want to set up, is to raise money from outside investors every few years. The main reason we want to set this up is so that everyone at Buffer has an ability to sell some of their shares for cash if they’d like. With this round in November, those who had shares vested (will describe what vesting means below :)) had the option to sell some shares. Joel, Leo and Andy sold a little bit. Let me know if you have questions about this!

Looking at this differently:

In general, salary is a safer bet, it’s money that you’ll get guaranteed every month, so choosing higher salary will give you an immediate benefit of more cash in the bank up front.

Equity has more risk, as it’s not guaranteed that Buffer will sell for any of the above amounts. The equity difference between the two offers is 30%, so by picking the higher equity, you get 30% more options than with the lower.

Also, our vision for Buffer is to keep going with it for a long time, so we might not exit for quite some time, there will however still be opportunities to sell your options along the way – the above examples of “exit”, just make it easier to understand, we’re not very likely to sell at this point!

From our side, we don’t have any preference of what’s best, as it always depends highly on the circumstance of each individual people ( for example families, new bought houses, and other more immediate financial responsibilities are often a reason for people to choose higher salary)

Important: If Buffer raises more money from outside investors there’ll be a dilution for you. That means if we raise more money, say 10 million whilst being valued at 100 million – 10% will go to investors. So now only 90% is left for the rest of us who are owning stock/options, which means you’d have to multiply your existing options by 0.9 and you’d lose 10% of your value of the options.

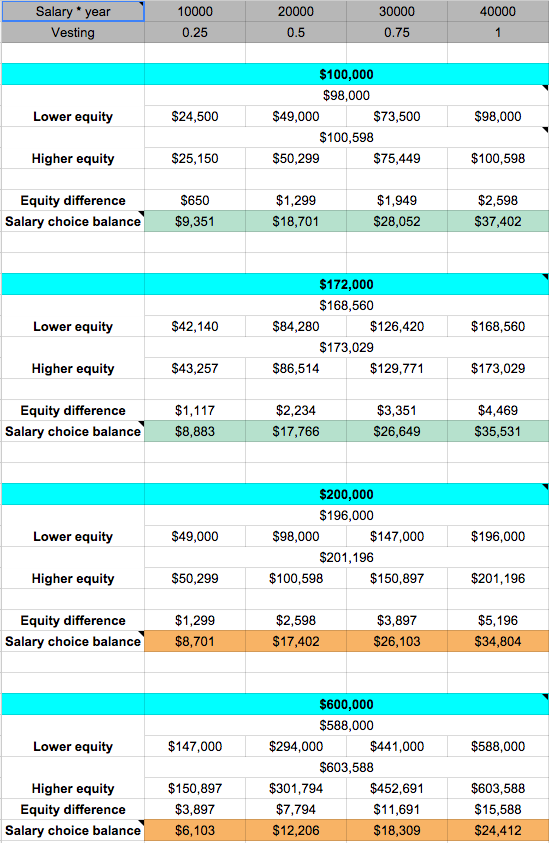

*Vesting: There is a ‘vesting schedule’ that we follow, and it’s quite standard across most startups. Ours is a four year vesting schedule, which basically means after working four full years, all of the equity will be officially vested (meaning: yours). After working at Buffer for 1 full year you’ll pass your ‘cliff’ which means you officially own/arevested in 25% of the shares that are offered to you. After that cliff, every month you will vest an additional 75% of what’s left. If there is any liquidation event, like us selling or IPO’ing or so before you’re fully vested through the schedule, you will automatically vest in all your shares :).

What this looks like at $100M, $200M, $600M

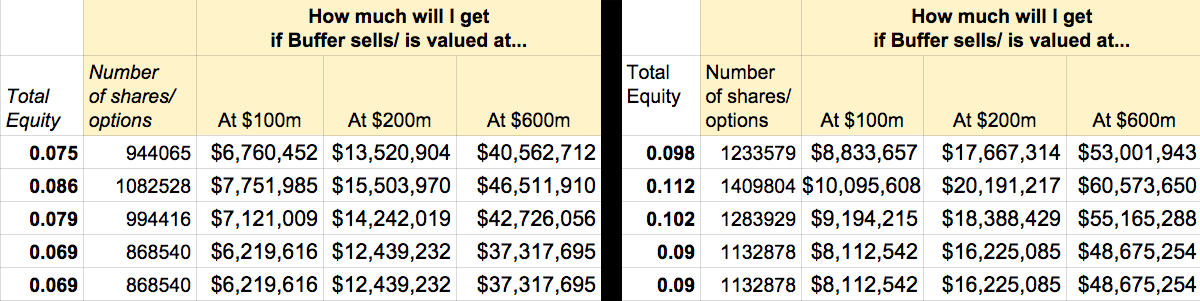

In case it might help to see how all the above looks with some comparisons in mind, here’s a look at the stock options spreadsheet and worksheets we use to help understand all these figures.

Here’s what the equity options look like for some of our newly added teammates as they choose between the $10,000 higher salary option and the higher equity option, and what those options could mean if Buffer were to sell at the price points of $100 million, $200 million, or $600 million (none of these are guaranteed, of course!):

Again, these numbers are determined using our salary formula and equity formula.

Common questions we hear about equity

Once we have sent out this email, it’s not at all uncommon to get lots of great questions in return, asking about details we did not think to mention! Here are some common questions and how I have tried to answer them in the past.

How does vesting work?

Equity is granted over a vesting schedule of 4 years, with a one year cliff. Here is what it means:

- After 12 months at Buffer you will get 25% of your total equity. If you leave before 12 months, you will not be able to access your equity. (The reason this exists is so that no one “tricks” us into just getting some equity, through for example joining for just a month, and then quitting. We don’t have a feeling that that would ever happen and have full trust in our team members, it’s just a longstanding legal precaution that we’ve felt makes sense to adopt. It also gets really messy as it takes time to know whether someone is a fit in the first few months and quite a few people end up leaving Buffer before the 1-year mark, so doing paperwork around equity if someone was only here 2-3 months would get messy quickly.)

- After 12 months, a bit more of your equity will be accessible every month until you can access your full equity (that is after a total of 48 months, or 4 years, at Buffer). After 12 months, your equity will vest an additional 1/36 for the next 36 months. So now, at any point after the 12 months, where you leave Buffer or Buffer sells, you get equity for the time you were here.

- That means that starting at month 13, you can access an extra 1/36 of the remaining equity.

- As an illustration, if you were to leave after 2.5 years, that is (12+12+6) months = 30 months spent at Buffer, 30/48 = you will be granted 62.5% of equity.

- If they leave after 18 months for example, and they had 100 options on their full equity plan, they can now get: 100 * 0.375 = 37.5 options, which we’d round up to 38 options.

What if someone leaves Buffer before an exit or liquidity event?

So far, we’ve had a number of people leave Buffer after they had vested some of their stock options already. Since the 409a valuation was still fairly low, it was only a few hundred or a couple of thousand dollars for them to exercise their stock options on the way out.

After our most recent fundraising round, where our 409a went up significantly (our price per share went from $0.17 to $0.77), it’s starting to become more and more of a financial burden for someone who wants to leave Buffer to still be able to exercise their stock options.

To combat that, we’re working with our lawyers to extend the expiry date of stock options to 10 years, instead of the standard 90 days. This is something that Pinterest has recently done for all their team members, which was really amazing to see—even at their size, that is still a change they were willing to make.

Will my stock get diluted?

In 2-3 years, it’s very likely that we’ll have another financing round. The reason we would do this is to give us an opportunity to let team members and investors sell their shares. Ideally, these events don’t lead to a lot of dilution and instead it’s more of a trade in ownership of certain shares—no new shares are being issued.

(In an ideal world, this is the path we would choose. However, there is still some risk here. It’s hard to know exactly where Buffer will be in 2-3 years, whether financing will be viable and a few other factors.)

Increasing the option pool for teammates is very likely, which will lead to dilution, however usually much less than a round of financing. Right now, we topped up the option pool again and are confident that that’ll get us quite far.

If Buffer raises more money from outside investors, there’ll be a dilution for you. That means if we raise, say, 5 million while being valued at 50 million, 10% will go to investors. So now only 90% is left for the rest of us who own stock/options, which means you’d have to multiply your existing options by 0.9 and you’d lose 10% of your value of the options.

How do you feel regarding our last round’s valuation at $60m?

Generally, valuation is very closely tied to your growth rate. If you’re growing fast, you can almost ask for any multiple, if you’re growing slower, then the valuation will drop. It’s a key reason we have a big ambition to grow Buffer, I think it’ll be a better outcome all around and for everyone involved.

What do you think I should choose?

There’re a lot of different ways to look at this. We’ve found that often salary is a safer bet; it’s money that you’ll get guaranteed every month, so choosing higher salary will give you an immediate benefit of more cash in the bank up front.

Equity has more risk, as it’s not guaranteed that Buffer will sell for any of the above amounts.

From our side, we don’t have any preference of what’s best, as it always depends highly on the circumstance of each individual people ( for example, families, new houses, and other more immediate financial responsibilities are often a reason for people to choose higher salary).

Resources that help explain equity concepts

We’ve found and created a few resources that can be really helpful for working these numbers out.

Here’s an immensely helpful equity earning calculator you can use to play around with the numbers.

We’re also keen to share transparently how we come about all our salaries, equity and calculations:

- Buffer’s public salaries formula and spreadsheet of all teammates’ salaries

- Buffer’s public equity formula and spreadsheet of all teammates’ equity

- And here’s our own stock options spreadsheet and worksheets, with an equity-calculating sheet :)

What are your equity questions?

If you’re thinking about how to explain stock options to your team members and giving them a clear idea of what it might mean for them, I hope the above can help!

We’ve also published a lot more around transparent salaries, stock options, pricing and revenues on our Transparency Dashboard that you can check out.

Are there other questions we can answer about equity, how it works at Buffer, and how we explain it to teammates? What resources have helped you understand or explain these concepts better? We’d be keen to hear all your thoughts and feedback in the comments!

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.