Rachel Pereyra began freelancing as a virtual assistant in January of 2020 to earn extra money to help her and her wife pay off their debt and save for a house. By that summer, she had proven she could secure a steady stream of clients and charge enough for her work that she could actually make money working for herself.

Later in 2020 when the pandemic required her to leave her corporate job and care for their children, she started leaning more heavily on freelancing work, and Mastermind Business Services was born. Her consultancy helps scaling agencies optimize their internal processes and tech tools. She has collaborated with over 50 clients during her three years in business, and those clients have achieved remarkable outcomes.

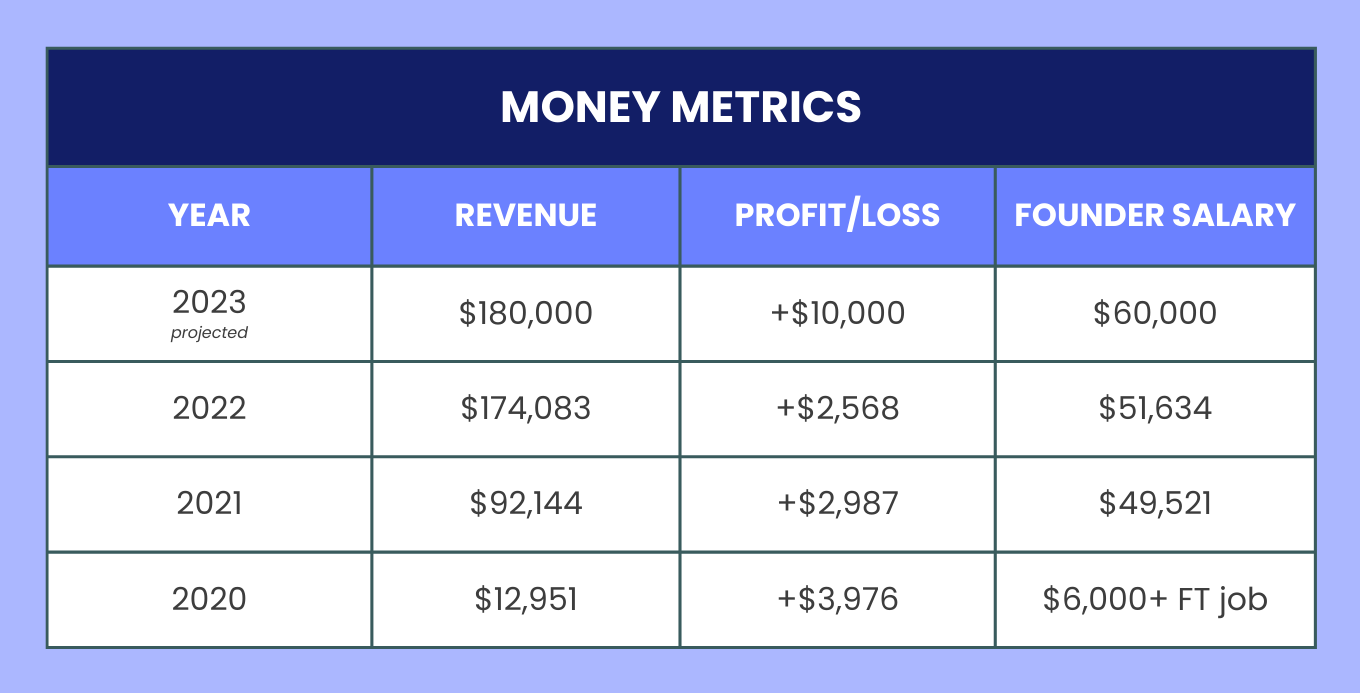

Now the primary breadwinner in her family as her wife changes careers, she doesn’t have the luxury of not being able to bring home the necessary income. This reality has required her to invest as little as possible (she started her company with only a $400 laptop and has bootstrapped her growth at every step). Plus, she’s had to be profitable from the start. Below, she shares exactly how she made it happen.

Years in business: 3

Number of employees: 7 contractors

Location: Austin, Texas, with team members across the U.S. and in Europe and Canada

Initial capital invested: $400

Financial support for business: I have leveraged credit cards and $25k in business loans to get capital to invest in times of expansion

Revenue streams:

- Agency and consulting clients on a project and retainer basis

Growth Journey

What’s been your proudest financial achievement as a business owner?

I have been able to maintain a profit every year I have been in business while also paying myself. I can’t even begin to explain how deeply moved I am to be able to support my family and maintain profitability in my business.

When I was a senior in high school, I was working full-time hours while taking dual credit classes and attending high school. I had found a job I loved at the local grocery store and worked my way up to entry-level management. All of this changed when I got pregnant with my first child four months before high school graduation and had to move in with my now ex-husband and his family.

Those times were the roughest of my life—our first year filing taxes as a married couple, we made $12,067 total. After we got divorced in 2012, I hustled to give my kids the childhood I had growing up, working a full-time job in finance, nights as back office admin for a florist and wedding coordinator, weekends flyering for a realtor, and lunch breaks driving for Uber Eats.

I began freelancing as a virtual assistant in January of 2020 to earn extra money to help my wife and I pay off our debt and save for a house, but I quickly realized that I am not a great assistant. I’m a more strategic and big-picture thinker, so I began working with clients as an online business manager in the summer of 2020. By the end of the summer, I had demonstrated to myself that I could secure clients and potentially support my family with this work.

I don’t pretend to have everything figured out—there is always room to increase margins, raise rates, or reduce expenses—but a hunger for work and client satisfaction has been my biggest secret to success. My clients love working with me and truly trust me. This, paired with the fervent networking I have done over the years, has led to consistent work and higher-level clients.

I’m also always looking for ways to add to my revenue. One reason my agency has stayed afloat in times of transition is because I have been willing to pick up a contract as a project manager, a fractional COO, a recruiter, or basically anything that allows me to continue investing in my business.

How do you decide how much to pay yourself versus invest back in the business?

In my first year of business, I invested almost all of the money back in the business via certifications, coaching, team members, software, and hardware. I was able to do that because I still had my full-time corporate job until October 2020.

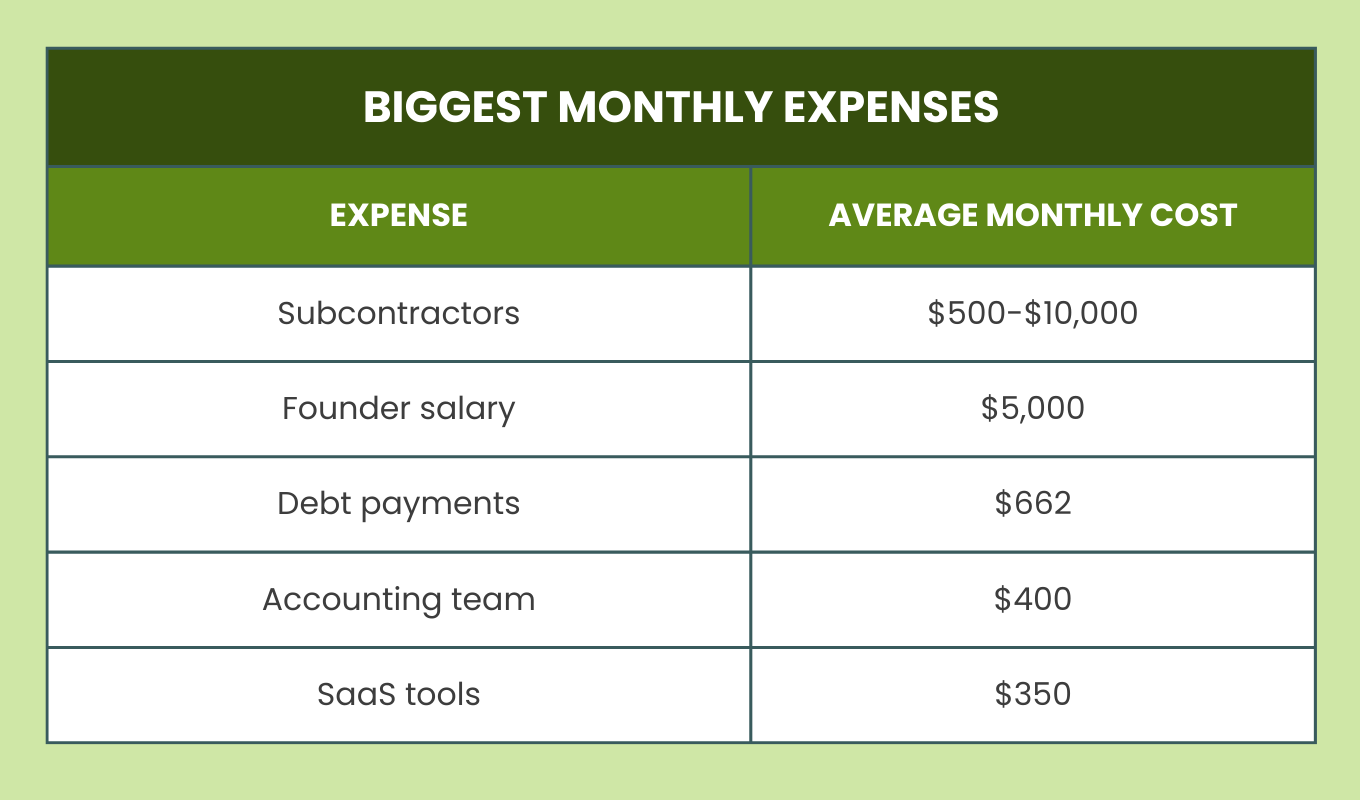

Since I went full-time on my company, the decision of how much to pay myself comes out of necessity. I am currently the primary breadwinner in my family, so the business has to support that first. This means I need to bring home at least $5,000 a month for our family obligations while my wife is growing her own career. Sometimes doing this means investing less into business growth to put family first.

Leveraging debt has also been very helpful for me in balancing these priorities. I don’t see debt as a negative thing, but it is important to be aware of the risks. I’ve definitely pulled out the credit card to invest in growth at times when the cash flow wouldn’t allow for it, such as paying for a corporate sales program. Not all of my debt has resulted in a better situation or payoff for me, and in hindsight there are things I wish I had waited and saved for instead. But I still think leveraging debt to grow as a business owner makes sense if you have a solid plan for how you will get an ROI back from the investment and a backup for how to pay off the debt if you don’t see the planned ROI.

What specific strategies or marketing techniques did you employ to attract your first customers or clients? What are a few of your most impactful growth strategies now?

I got my first clients from Upwork and Facebook groups. If you are just starting out or are in a tough time financially, spending the energy on these resources can be fruitful and yield dividends, but it isn’t an easy path.

When I was starting on Upwork, I was making as little as $10 an hour as I built my reputation. I was able to make this work because I was still in my corporate job, but that rate wouldn’t support my life now. I still submit proposals on Upwork because more large companies are using it to find fractional or contract talent in my line of work. Profile videos, testimonials, example projects, and being aware of market rates will help you stand out from the crowd.

Facebook groups can be lucrative, though they require a lot of outreach. I find groups run by people I admire so the folx in there are values-aligned or groups my ideal clients are hanging out in. Then, I watch the posts for people struggling with something I offer and comment with some advice or an invitation to discuss a bit in the DMs, and if we are a good fit hop on an initial consultation call.

Since then I have done a lot of networking, including joining professional platforms like Dreamers & Doers and The 10th House, finding niche Slack channels my colleagues or clients are spending time in, and attending events with local business groups.

I approach networking from a perspective of relationship-building and not sales so I am more likely to come across as genuine. I have learned not to be afraid to tell people about what I do, without treating every conversation like a sales pitch. For example, I like to share about some of my successful clients, my favorite industry trends, or exactly what kind of business I am looking to support right now.

I deliver stellar client services, which makes it more likely that my clients will refer me to others. During the economic turmoil of 2023, my business has been sustained purely through referrals from previous clients and people I have met via networking. This is reflective of the way I take care of my clients beyond the end of the project: keeping up with birthdays, checking on how their business is doing, and having regular catch up calls.

What’s a turning point that really impacted how you thought about your business or approached growth?

Early on, I spent a lot on programs to learn skills I didn’t have to help me run my business—so much that I had to take on debt to make it possible. I ended up with tons of knowledge, but then never used a lot of it because I didn’t have the bandwidth to apply it.

I realized I was using coaching and learning as a crutch to prop up my internal self-worth and money mindset issues. If I could go back, I would have spent that money on hiring experts (and some extra therapy to work through why I felt like I needed more certifications and training). Now, I pride myself on bringing other people in to support me when I need different skills to grow the business.

What have been the greatest growth or money challenges you’ve experienced? How have you worked through them?

One of my biggest struggles as an entrepreneur has been staying out of my clients’ pockets. When I started out, I so badly wanted to support early-stage and micro businesses, so would price myself low with their budgets in mind. This meant the first two iterations of my business weren’t sustainable—no matter how I sliced my expenses, not enough revenue was coming in. Yet, I was scared to pitch clients who could actually afford me, because I felt if they rejected my business they were rejecting me as a person. This stunted my growth and created more financial struggle for me both personally and professionally.

Working through this has taken a combination of great clients singing my praises, a team who is supportive and willing to check me when needed, and regular therapy as much of this is reflective of my own traumas and past experiences.

What are your next growth goals? What do you plan on investing in to help you achieve them?

I am working to refine my profit margins to make the business more sustainable for the long-term. I’ve realized I need to work with clients who are bringing in $1 million or more in annual revenue so they are prepared to invest in our larger projects.

I also am working on fostering monthly recurring revenue via retainer support for small- to mid-sized businesses. We have already started offering this to current and previous clients, and it’s been exciting to bring back retainer support in a more holistic way.

I also know I need to increase the number of leads in my pipeline beyond just referrals. I’m working on developing a cold outreach strategy to corporations and larger nonprofits, but this pipeline takes longer to close than single-founder businesses, so I plan to maintain our smaller support services while we grow to keep the cash flow coming in.

As we grow and stabilize in the next few years, I would like to co-found a new business. I am very much a visionary and have lots of ideas that don’t make sense to launch through my current business. With better profit margins, I hope to be able to expand my internal team and invest in a fractional CMO so we can take on more clients without me having to be involved in each nitty gritty detail.

Based on your experience, what advice would you give someone who had a business like yours for growing successfully?

The best advice I got early on was that my own money mindset would limit my business and that I needed to be cognizant of the ceilings and hurdles I am creating for myself and the company financially.

Growing up comfortably middle class and then being below the poverty line from ages 18 to 23 definitely left a permanent impact on the way I think about money and make decisions. This isn’t something mantras alone can fix—for me, this is a deeply rooted trauma I am still working through. I see a therapist regularly and have learned to ask for help and identify my financial triggers to support my journey.

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.