Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well.

Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how you can apply their insights to your own small business journey.

Ari Krzyzek began her design journey working for Bali’s top hospitality company, earning just $250 per month. Growing up in Bali with no exposure to financial planning, she believed this was a fair salary at the time.

After relocating to the U.S. and marrying her now-husband, Peter Krzyzek, she became inspired by the vast potential of freelancing and remote design work, and they co-founded Chykalophia (see-ka-lo-fia) in 2011: a web agency helping women-led brands in B2B tech and Femtech DTC transform their websites into platforms that drive business growth.

Navigating the financial aspects of running and growing a sustainable business initially proved difficult due to her lack of financial knowledge. Starting the company with just $200 and her laptop, she didn’t have any clue what she really needed to fund a business, from general administrative and operating expenses to marketing and so much more.

But she bootstrapped her way through every problem, learning how to manage a budget effectively and understand the basics of business finances. Her dedication to networking within the Chicagoland business community led to significant growth by 2016, allowing her to commit full-time to their venture. Since then, she has worked with small businesses, startup founders, and notable brands including Google, Verizon, Sephora, Honest, and Adobe.

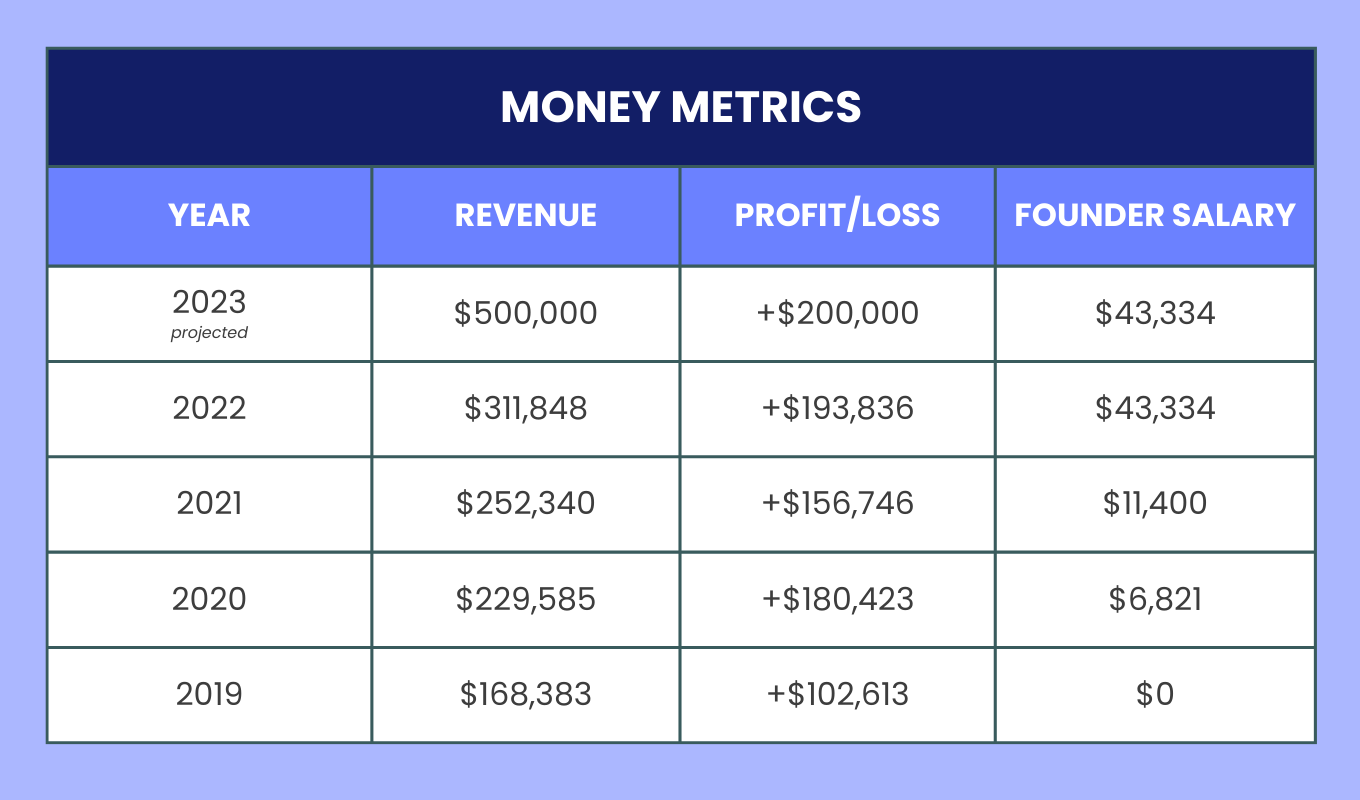

Today, the company is on track to reach $500,000 in annual revenue. Here, she shares her growth path and the business and financial lessons she’s learned along the way.

Business Snapshot

Years in business: 12

Number of employees: 14 full-time, 3 part-time

Location: US, Canada, Serbia, India, Philippines, and Indonesia

Initial capital invested: $200

Financial support for business: Grants for $10,000, economic injury disaster loan (EIDL) for $80,000, bank loan for $23,000

Revenue streams:

- Monthly retainers for branding, web design, and development

- One-off project fees for strategy workshops, branding, UX, or web projects

- Passive income (design templates in creative marketplaces)

- Speaking engagements

- Consulting calls

- Book sales

Growth Journey

What’s been your proudest financial achievement as a business owner?

Starting my business without savings or financial know-how was daunting, so I’m proud of how much we’ve learned and figured out along the way.

I taught myself how to manage our budget effectively and understand basic business finances like cost of goods sold and P&L. I also participated in accelerator programs like the Women in Entrepreneurship Institute at DePaul University and Goldman Sachs 10,000 Small Business to help me further make sense of our finances.

Now, I’m exploring ways to maximize profit using what I’ve learned along with support from my CPA. They’ve guided us in adjusting our company structure, managing our expenses, and establishing solid financial protection around tax and legal matters.

We’ve also streamlined our financial processes, improved report management, forecasted accurately for growth, and allocated specific budgets for team advancement. We can now offer better benefits to our employees while maintaining enough profit for continued growth.

What have you found is worth paying for to help you grow, and what have you been able to achieve more scrappily?

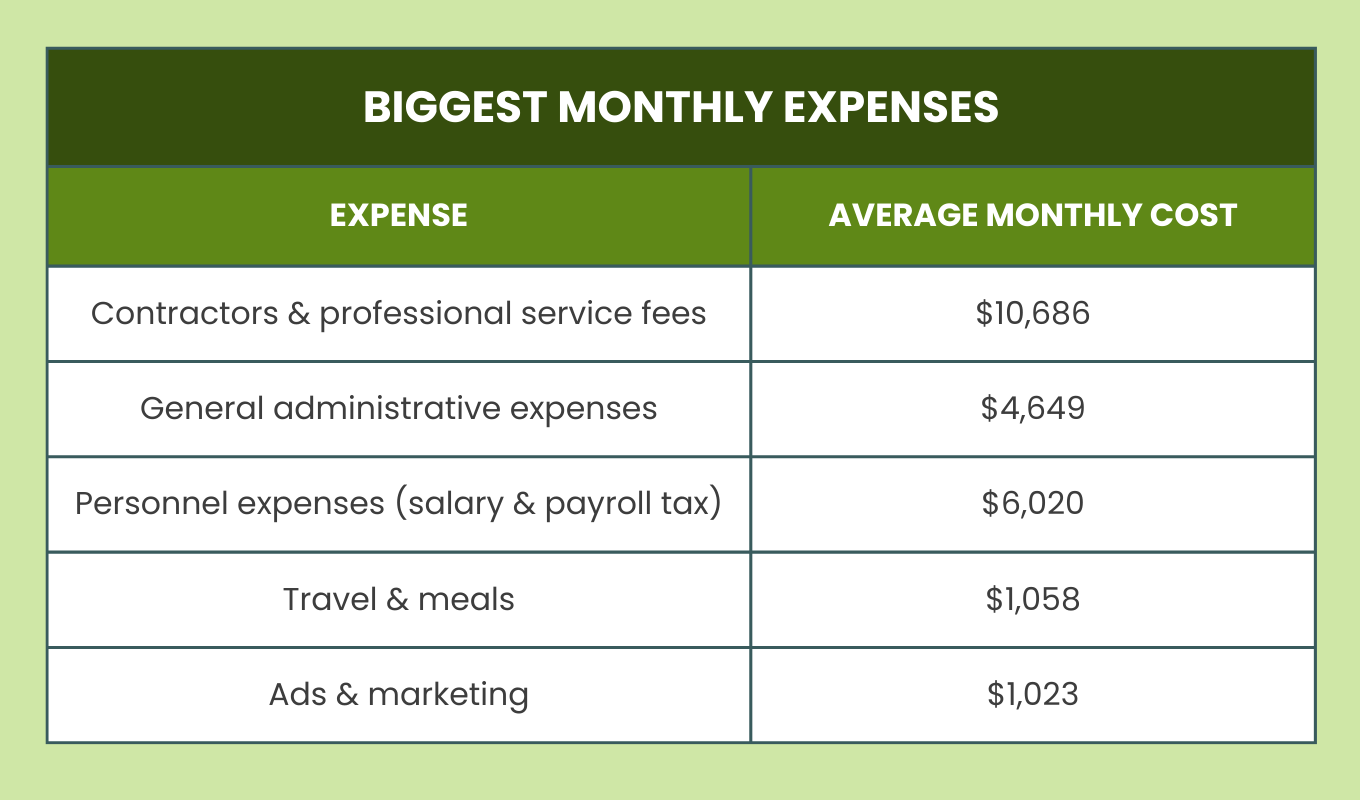

For me, it’s worth investing in areas I’m not skilled in or don’t enjoy, like bookkeeping and business tax. Hiring a trusted partner for these tasks is invaluable. They do more than just the basics: they guide us toward effective solutions and improvements tailored to our needs.

Another worthy investment is quality SaaS products and business tools that enhance efficiency. As we grow, we can’t afford to waste time fixing small issues.

On the other hand, I have been able to save money by leveraging our strengths in branding, marketing, and tech-related activities. We’ve built an in-house server with its own chat management using third-party plugins, which saved us from purchasing Slack accounts. Our team of creative geeks excels at creating brand identities along with visually appealing materials for our website and marketing campaigns, saving on design and development costs.

How do you decide how much to pay yourself versus invest back in the business?

Deciding between personal payment and reinvestment in our business is a question my co-founder and I grappled with. Only recently, in 2022, did we start paying ourselves after restructuring the business, updating our books, and sorting out legalities. We rely on our CPA’s guidance to balance personal income needs with investing back into the company.

This venture provides our main source of income. So we prioritize building a solid financial foundation by often choosing reinvestment over large salaries. In emergencies, we tap into savings or consult with our CPA about taking owner’s distributions.

Tell us about your team. At what point did you decide to hire employees or contractors? How do you think about when and who to bring on now?

Chykalophia began as a duo—just me and my co-founder. As our reputation grew and the demand for our services surged, we were stretched thin. Recognizing the need to scale and better serve our clients, we expanded our team in 2017.

Initially, we brought on interns, providing them with valuable industry experience while benefiting from their fresh perspectives. As our project load increased, we transitioned to hiring part-timers and contractors, ensuring that we had specialized expertise for each project. Over time, as our client base and project complexity grew, it became essential to have dedicated full-time team members. This led to the establishment of distinct departments within Chykalophia, including development, design, and marketing.

Today, as we continue to grow, we’re on the lookout for senior team members who can take the lead on streamlining projects, mentoring junior team members, and enhancing our operational efficiency. In essence, our hiring decisions are driven by a combination of immediate project needs and our long-term vision for growth and excellence.

What specific strategies or marketing techniques did you employ to attract your first customers or clients?

When I first embarked on my entrepreneurial journey, I understood the importance of establishing a strong reputation by showcasing the depth of my expertise in web design, user experience, and branding. One tactic that really helped was leveraging online platforms for creative professionals, such as Behance.net and Dribbble, which not only provided a space to display my work but also facilitated interactions with a global community of designers and creatives. As I collaborated with other professionals, they often referred clients to me. This organic word-of-mouth marketing, combined with the visibility from online platforms, played a pivotal role in attracting my first set of clients.

What are some of your most impactful growth strategies now?

Thought leadership is a cornerstone of our growth strategy. Consistently sharing insights, publishing articles, and participating in industry discussions not only showcases our expertise but also fosters trust among potential clients. We post our content on LinkedIn, host our own workshops and summit events for entrepreneurs and business owners in the Chicagoland area, and have even published our own marketing book, Made to Sell: Creating Websites that Convert. These strategies help our target audience see us not just as service providers, but as industry experts who can guide them through the complexities of the digital landscape.

Another pivotal strategy has been actively embedding ourselves within the entrepreneurial community through organizations such as HeyMama, The Futur Pro, Women’s Business Enterprise National Council (WBENC), 1871, and Goldman Sachs 10,000 Small Business Alumni network. By forging partnerships with fellow entrepreneurs, organizations, and developmental programs, we’ve expanded our network exponentially and ensured that we’re consistently in front of the right audience.

What’s a turning point that really impacted how you thought about your business or approached growth?

My upbringing in Indonesia, a developing nation, initially shaped a limited perspective on business and growth. The environment I grew up in didn’t necessarily champion entrepreneurial ventures, and my lack of exposure to the broader business world made it challenging to fully grasp my unique value proposition. The fear of failure, a sentiment deeply ingrained from my early experiences, often overshadowed the potential for success.

A pivotal moment in my entrepreneurial journey came between 2016 and 2017 when I decided to focus on my business full-time, and I crossed paths with Chris Do, a visionary in the realm of creative thinking. His mentorship was transformative, and he introduced me to the idea that creatives aren’t just service providers but change-makers. He illuminated the profound impact we can have on our clients’ businesses, their communities, and even on the world at large.

Embracing this new perspective allowed me to shed the inhibitions of my past and recognize the unique strengths and value we bring to the table. Our overarching objective is to uplift women-led brands, enabling them to grow, scale, and leave a lasting, positive imprint on their communities by harnessing our expertise in strategy, creativity, and technology. We pride ourselves on being there for our clients, every step of the way—from the inception of a business idea to its execution and growth. The relationships we cultivate with our team and partners go beyond mere transactions; they are built on mutual respect, shared ambitions, and a relentless drive to champion each others’ interests.

With this renewed clarity, we became more discerning in our client engagements, prioritizing projects that not only aligned with our expertise but also resonated with our core values. We assess potential clients for alignment through a mutual exploration of values and goals to ensure we can collaborate in a way that allows everyone to succeed.

What have been the greatest growth or money challenges you’ve experienced? How have you worked through them?

The first two years were challenging: We were bootstrapping everything and our lack of savings was preventing us from growing sustainably. Finally, I decided to return to a full-time job at Sears Holdings to allow us to keep pushing forward with our business.

Using saved funds from my job gave us the ability to pursue marketing opportunities such as community involvement, networking within industry organizations, and contributing back locally while also promoting our business and gaining brand exposure. These efforts helped us secure our first 50 clients within five years and set up a strong foundation for the business’ growth.

What are your next growth goals? What do you plan on investing in to help you achieve them?

My next growth goal is to prepare my company for sale within the next 20 years. To accomplish this, I’m making strategic investments in our team and operations, including building out our leadership team and enhancing personal and professional growth within the company. We’re also working on refining our business processes to achieve better efficiency.

Based on your experience, what advice would you give someone who had a business like yours for growing successfully?

Before you diversify, dominate. Start by making a mark in a specific niche industry. Once you have a stronghold there, consider branching out. It's essential to know that you can't be everything to everyone. Pinpoint the audience segment that will derive the most value from your offerings, tailor your approach to resonate with them, and then build a robust network that recognizes and values what your business brings to the table.

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.