Buffer is a fully distributed team, which means that our teammates work from anywhere!

Our official headquarters is in California, but we don’t have an office anywhere anymore.

Although this is rare, it seems to be a growing trend. As we grow, it has been great to see how larger remote companies such as Automattic and Toptal set up their distributed teams of over several hundred team members!

Today, about half of the company is based outside of the US. But as an officially American company, we issue payments in U.S. dollars to team members—even those working internationally.

It’s a unique setup for many of our teammates, and recently we’ve been digging in to understand their experiences.

For instance, an international team member spends an average of $852 a year on accounting services.

It’s fascinating to see how each country handles pay and taxes a bit differently.

Similar to how we share our salaries openly, we’re now happy to share the financial setup of a 6 Buffer teammates around the world, including how they’re set up as remote workers, how much they pay in taxes and where that money goes.

Meet Colin, in the UK!

Colin is an happiness engineer who joined Buffer in February 2013. He lives near Cambridge, in the UK with his wife, Caity, and their cat, Mr. Perkins.

In 2013-2014, Colin received an income of $90,000 from Buffer, which translated into a taxable income of £58,398.

In the UK, Colin is registered as self-employed—you can find more information about this status on the UK’s Business Tax governmental website. Colin has been kind enough to share everything he has been paying:

| Income | $ (USD) | £ (GBP) |

|---|---|---|

| Yearly Income Before Tax | 90,000 | 58,398 |

| Yearly Income Tax | 25,844 | 16,701 |

| Yearly Income After Tax | 64,156 | 41,458 |

| Monthly Income Before Tax | 7,500 | 4,846 |

| Monthly Income After Tax | 5,346 | 3,454 |

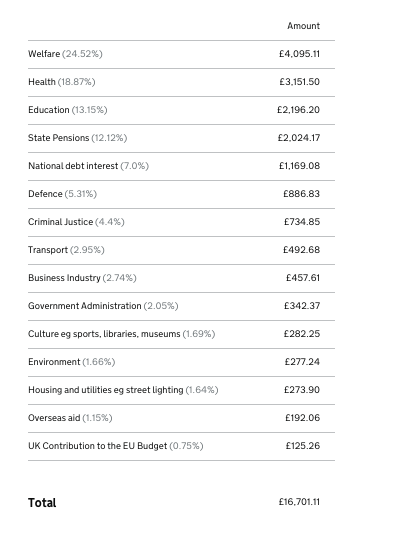

Here is the full breakdown of where Colin’s £16,701,11—the 28.79% of his income going towards contributing to various governments services—were allocated:

Meet Mary, in San Francisco!

Mary is a Happiness Hero, who works at Buffer from San Francisco with an annual salary of $92,108.

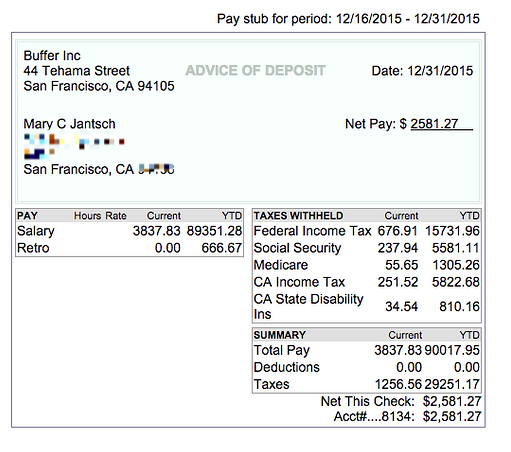

She kindly shared her last pay stub of the year to help us understand a little bit more about where the money goes when you are employed full-time at a San Francisco-registered startup.

Out of a total pay of $90,017.95 for 2015, Mary paid out a total of $29,251 in taxes:

- $15,731 in federal taxes

- $5,581 in Social Security

- $1,305.26 for Medicare

- $5,822.68 in state income tax

- $810.16 in disability insurance

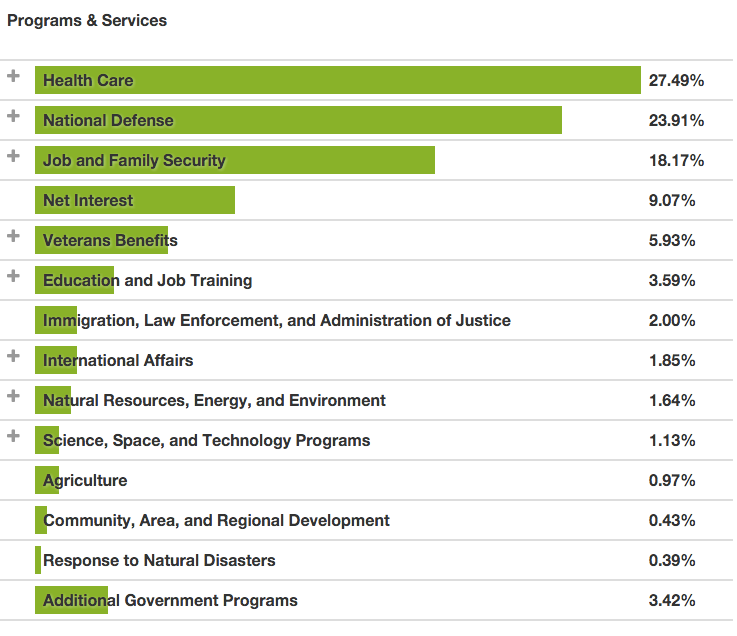

That’s a 32.5% overall tax rate for Mary. What does that money go toward? Here’s a breakdown from whitehouse.gov.

Meet Tom, in Canada!

Tom is an Android engineer who joined Buffer in June 2014. He lives in Guelph, Ontario with his girlfriend, Krista, and their dog, Jessie.

In 2014, Tom received an income of $52,872.33 (since he joined mid-year). On this he paid $13,513.66 in taxes and into the mandatory Canadian Pension Plan.

Being self-employed, Tom does not pay into Canada’s Employment Insurance, but he pays “double” what an employee of a corporation would pay into the Canada Pension Plan (employers in Canada match CPP contributions to the yearly maximum).

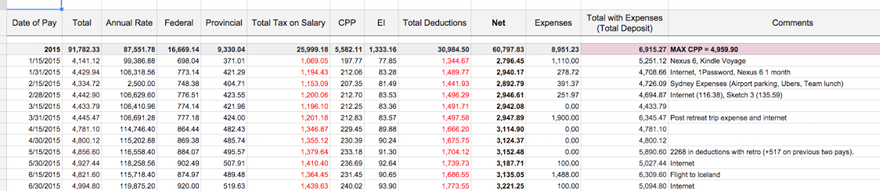

Tom is set up as self-employed, and keeps up with everything by subtracting any expenses, then plugging in the numbers in this calculator to get his deductions. He keeps track of each item in a spreadsheet that looks like this:

He puts the total deduction amount in an basic checking account he uses just for deductions. This is good to have when the Canada Revenue Agency asks for their share!

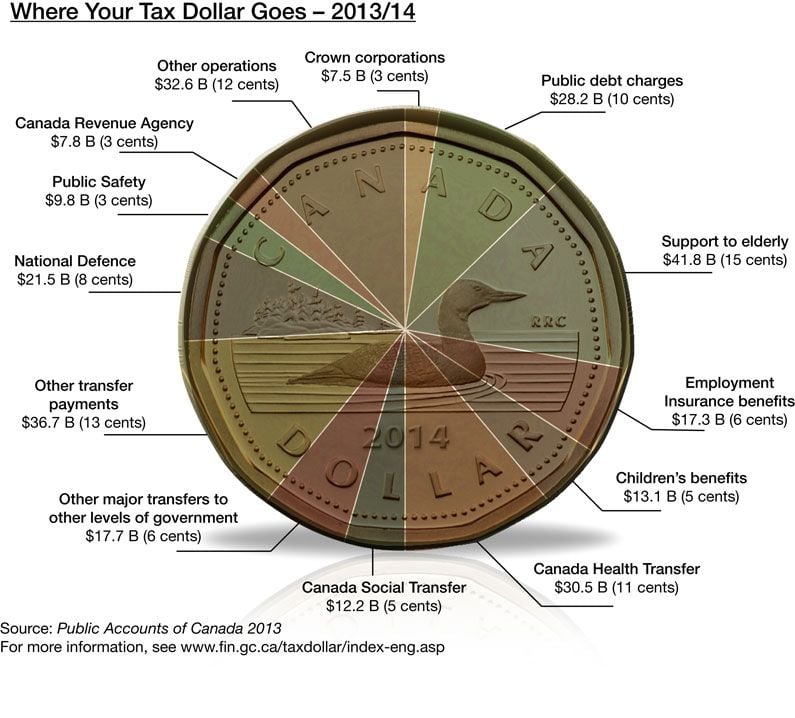

Speaking of their share: With a taxable income of $52,872.33, Tom estimates his effective income tax rate this year to be ~33.1%. Here’s what Canada will focus on:

This year, he has paid the CRA in installments, once per quarter via online banking.

Last year, as it was his first year being self-employed, he just paid it all at once at the end of the year.

Meet Ivana, in Croatia!

Ivana works at Buffer as a software engineer and receives a salary of $92,000 annually. She lives with her husband and her daughter in Zadar, Croatia.

Approximately 55% of her salary goes toward taxes.

In Croatia, it is the responsibility of the employer (not the employee) to pay state taxes and all other obligations.

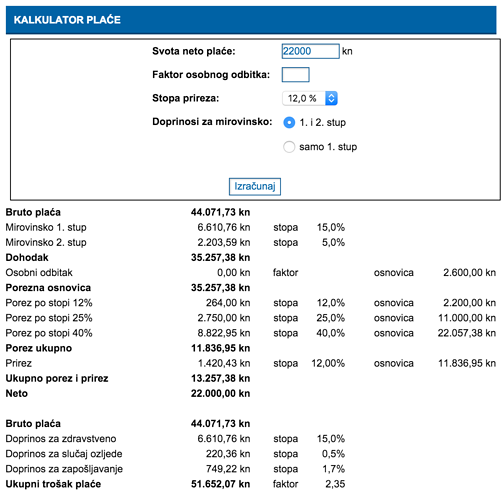

Croatia has three possible tax rates, depending on one’s salary: 12%, 25% or 40%. The bigger the salary, the bigger the percentage—in Ivana’s case, it’s 40%. In addition, she pays 12% city tax.

Ivana has registered a company of which she is the sole owner and director. The advantage of this is that Ivana could lower her salary and thus fall under the lowest tax rate (25%).

However, she would then pay a company tax of 30% of her total yearly income (which in the end comes close to the 55% she would pay if Ivana didn’t lower her salary). You will find here a breakdown of where tax money goes in Croatia!

This is what the calculation looks like when Ivana pays herself the entire salary ($7,666 per month). She ends up with $3,142, which equals 22,000 Croatian kuna (the first number on the picture. The total amount $7,666 is displayed on the bottom of the image = 51.652,07 kuna)

Meet José, in Spain!

José is a back-end developer living in Madrid, Spain, who joined the Buffer team December 2014.

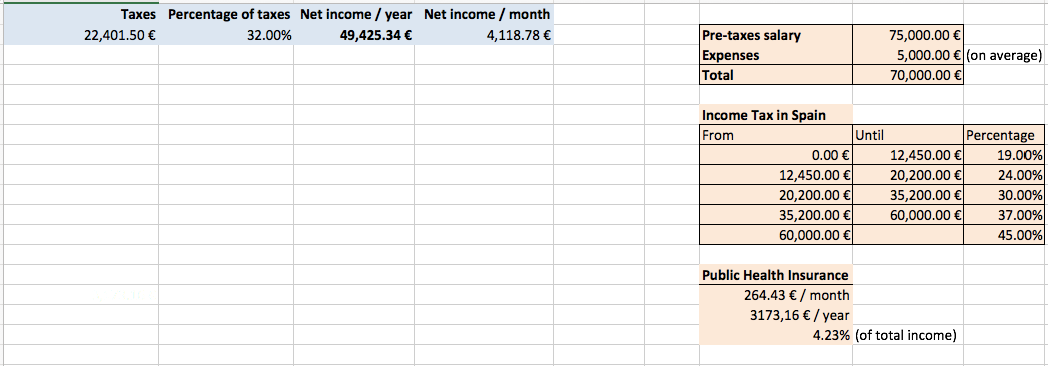

He’s currently working with a freelancer status in Spain (is it called “autónomo”).

For his status, it’s mandatory to pay for public health insurance. This is also tied to retirement expenses (since you cannot only pay for health insurance).

Since José only began working with Buffer at the end of 2014, 2015 will be his first year receiving a full, taxable income—for that year, he’ll pay 32% of taxes, plus another 4.23% on top of this for health insurance – that’s a total of 36.23% of mandatory contributions.

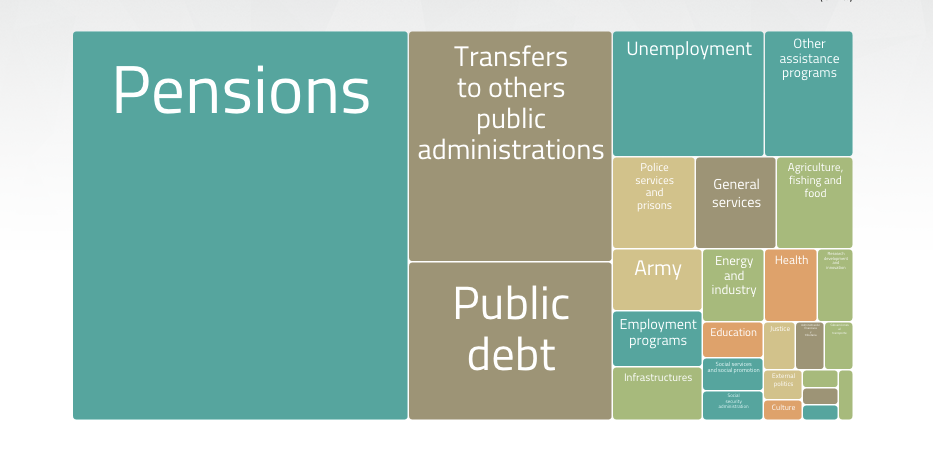

When the Agencia Estatal de Administración Tributaria (the bureau responsible for collecting national taxes in Spain) uses José’s contribution, it will go toward things like pensions, assistance programs, debt and more.

Meet Niel, in South Africa!

Niel is a front-end developer at Buffer in Cape Town, South Africa, who’s been with Buffer since August 2013.

Niel’s current annual salary is $101,141.

In South Africa, Niel is categorized as a freelancer/contractor. He pays a provisional tax every six months, which is a prediction of how much potential income he’ll earn throughout the year.

When he starts a new financial year, Niel heads to the South African online tax filing site and requests a preliminary report for his first provisional tax payment.

Then, Niel predicts how much he might earn from Buffer for the year. This allows him to see how much money he needs to put aside every month (in a separate account) so that he can pay twice a year.

Niel shared that he usually overestimates in case his calculations are off. If he does overestimate in the end, he gets a bit of money back.

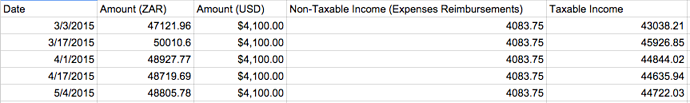

Inspired by Tom’s setup, Niel uses a similar system to track each payment and how much is taxable income:

At the end of the next financial year, he will file a full tax return. He does this with the help of a tax consultant, and usually sends over the exact spreadsheet he has been keeping tabs on for that year.

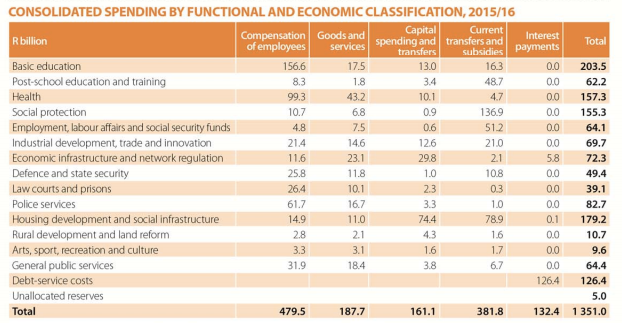

Niel’s effective tax rate is about 33%, and here’s a look at South Africa’s budget to see what this contributes toward:

Making it easier to understand finances around the world

Our incredible accounting firm, Foresight, assists us with all these payments around the world; they have been great in helping us grow our distributed team. They even issue payments in Bitcoin for some team members!

We’re currently trying to make it as easy as possible for all team members—especially international ones—to understand what they can expect financially when it comes to working with Buffer.

When we think about non-US based team members, topics such as taxes, accounting and health insurance come to mind. With 50% of the team being international, we’re eager to dive into all of those topics.

We’re surveying team members to understand their setups, and we’ve initiated a change in how we wire money internationally, helping us save over $100,000 per year.

Do you work with an international team or have a unique setup to make sense of your tax obligations? Do you have any tips for our team? We would love to hear your thoughts!

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.