Update: We closed a first syndicate on AngelList today, October 27th. We have opened a new one with VegasTechFund now here.

Update 2: All our public AngelList syndicates have been oversubscribed and are now closed. The full $3.5m is now committed. What’s left is for us to finish the due diligence process with our lead investor (Collaborative Fund) in order to hopefully close out the funding, then have the money wired. We’ll update you once this is all done. Thanks for following our crazy ride!

We’re super excited to share some big news today. We’ve decided to raise more funding for Buffer, and in line with our value of transparency, we want to share absolutely everything about it. On top of that, we haven’t closed the funding round yet and if you’re in a position to invest, we’d love to have you.

You probably have a ton of questions about this, so let me try and answer some of them here by giving the full context of how we came to this point. If you want to know anything else, drop a note in the comments below!

The Buffer story so far, and our key metrics

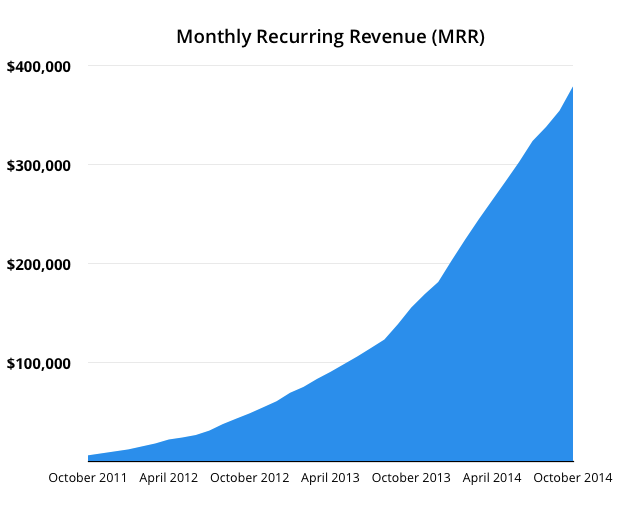

We started Buffer almost 4 years ago. It’s been quite an incredible journey, from a bedroom in Birmingham in the UK and generating $1k per month in revenue, to generating almost $400k per month today.

We were lucky to have some great investors put money into Buffer 3 years ago when we raised our seed round. At that time, we really needed the funding to grow the team faster and meet the demand we were seeing from customers.

A lot has happened since then. Over the years, the product has evolved into a full social media publishing and analytics platform with a lot of power. The team has grown to 24 incredibly inspiring people. We ended up traveling the world by accident, working from Hong Kong, Israel, South Africa, creating a culture of working from wherever in the world makes you happiest and most productive.

One of the most exciting parts of our journey so far has been in pushing the boundaries of how transparent companies can be, both with team members and with the wider public of customers, users, blog readers and other entrepreneurs. We now feel a duty to continue to be fully transparent about everything we do, always finding areas we can be even more open.

In light of this focus on transparency, here are the latest Buffer stats:

- 1.8m users have registered for Buffer.

- 165k users are active on a monthly basis (shared at least one post).

- We have 28k paying customers on the Awesome or Business plans.

- Annual Recurring Revenue (ARR) is currently $4.6m. We’re generating around $385k a month.

- The team is 24 people, spread all across the world.

- That means Revenue Per Employee is around $181k.

- We have a strong focus on culture-fit and sometimes it means firing great people who have different values.

- All our SaaS metrics (LTV, churn, etc.) can be seen at our Baremetrics dashboard.

- We share the salaries of the whole team in this spreadsheet. Our salaries are $175k (Joel) and $161k (Leo).

- In our last round we raised $450k in funding at a $5m valuation and investors so far have owned around 14% of the company.

- We have $1m in the bank and have been profitable for the last 6 months.

We’ve been very happy with our progress to date. While the graph looks like a clear upward trend, things have not necessarily always been smooth. We’re lucky to be part of a great team and it’s been a combined effort to be at this stage. We will be working very hard and hope that things will continue to grow in the same way, but it is worth noting that if you choose to invest in Buffer that these numbers can’t guarantee future success or a return.

Why raise funding when we have $1m in the bank and have been profitable for the last 6 months?

We started generating revenue in the first week of launching Buffer and always focused on creating a solid business. We worked first towards earning money by building a valuable product and only when we had solid traction we decided to raise funding. Since we had revenues, we didn’t need to raise as much and retained a lot of equity and control to take the company in the direction we felt drawn towards.

In many ways we’ve been lucky to hit upon a product that solved a big problem for people, and for the social media market to be growing so fast. At the same time, we feel our discipline to building real value has helped us to reach $4.6m in annual revenue on only $450k in funding. On top of that, we’ve been profitable for the last 6 months and have grown our bank balance to over $1m.

So you might be wondering, why raise funding if everything is going so well and we’re in full control? Here are some of the reasons:

1. We’re removing pressure to sell, so we can go all in and keep building Buffer for the next 5-10 years

As we’ve grown Buffer, we’ve been lucky to receive quite a number of acquisition offers. Some have been easy to turn down, others really made us think hard. In thinking through acquisition offers, we realized that what we’ve created with Buffer is not something we want to give up. We’ve stumbled upon something truly special, and we’re lucky to have all of you following along. We also found that we’ve ended up as part of two big movements happening around companies working remotely and companies being much more transparent.

The conclusion we came to is that we’re still really just at the beginning when we reflect on the journey at a higher level, and we want to feel comfortable keeping going for at least 5-10 more years. We want to keep building a great product and solving important problems for customers, and we want to keep pushing the boundaries and showing how big a company can be and still be fully distributed and transparent.

One of the ways we came across to help us “go long” is for us as founders to take some liquidity. In this funding round, $2m of the $3.5m will be put aside for the two of us. We’ve both discussed this a lot internally. At times we thought “are we being greedy and just want money in the bank?”. In some ways that might be true. At the same time, we think it could be increasingly difficult for us to say no to future offers, especially since we still have so much equity in the company and some outcomes could be truly life changing. We want to be committed to the team, customers and to being part of the movements, and we feel that we’ll be better able to control our temptation to prematurely sell if we have some money put aside.

2. Setting up a precedent for multiple regular liquidity events for investors and team members

The general way a lot of startups work is that they’re usually putting all their eggs in one basket, “go big or go home” style and focused completely on the exit. You’ll be asked about exit strategy, and it’s almost the whole basis of why you might create a company. Along our journey, we’ve created a culture of not putting ourselves on the deferred life plan where we sacrifice now for hypothetical greener grass in the future. For example, being a distributed team means you don’t need to wait for a gap in your career to try traveling or living in a different country: do it right now and keep working while you do so.

Having investors and team members with stock options means that at some point, a return is expected. For a while, we wondered how we might handle this if we don’t want to ever exit. The great thing we’ve learned is that this is a solved problem. We learned this from Phil Libin:

“Sophisticated investors have totally decoupled exit from liquidity. Those two things used to be together, so you start a company and the investors want you to starve until you’re done, until you exit and then everyone gets their money back and that’s fundamentally stupid. Who does that benefit? Why would anyone want to put pressure on the founders of a company to potentially sell prematurely? So this whole idea of coupling exit and liquidity which was 99% of the time before, it doesn’t make any sense. The secondary markets today provide all the liquidity that you ever need, totally separate from an exit.”

This is our intention with this new round, to really set a precedent for multiple liquidity events going forward. Different investors will have different stages at which they’d like to get liquidity, and now they’ll be able to cash out at the time which is comfortable for them. New funds which are more focused on later stage capital can invest as we grow more and become more stable and predictable with our growth and revenue. The same applies for team members: if someone wants to put their kids through college or buy a house, they can choose to sell some of their equity. Others might not have as many commitments and may choose to keep their shares.

3. It’s a way to get partners on board who are excited about the unique way we’re running the company

One of the things we’ve realized in the last few years is that we’ve found ourselves on a very unusual path in terms of how we run the company. It’s created a unique and exciting way for us to build the company. Here are some of the crazy things we’ve done:

- Transparent salaries

- Transparent equity

- Public revenue dashboard

- Transparent email within the company (everyone can see all emails being sent)

While we’re excited to do things differently, it is also very polarizing and something a lot of people aren’t comfortable with. For this round, we wanted to surround ourselves with people that will push us to stay true to our values and even go further based on them. What we’ve found is there aren’t very many investors who are on the same page as us about these things. We also completely understand and appreciate the other approach. Luckily, we found that the ones who get what we’re doing are aligned to an incredible degree. We want to hang out more with these people. We believe Seth Godin said it best:

“The easiest way to thrive as an outlier is to avoid being one.”

More about our new partners a bit further down!

4. We want to add a little extra cushion to the bank to help us with any speed bumps that might arise

We have $1m in the bank and it’s steadily rising each and every month. Still, for this round, we took some time to really think about worst case scenarios that might hit us down the line. We want to be able to weather a few storms, if we need to.

There are some quite clear challenges we might have ahead of us which could cause us to grow more slowly:

- We have some great and impressive competitors which customers might choose instead

- We might not always create products and features that solve real problems and succeed in the market

- We might struggle to scale technically and keep the user experience and reliability great

- Something may happen that makes it hard to maintain or even damages our brand (for example, we were once hacked)

These are all factors where we feel it may be useful to have some additional cushion. On top of these, the worst scenario we came up with is for some of the social networks we’re built on top of (Twitter, Facebook, LinkedIn, Google+), to decide they aren’t keen on having developers build on top of them anymore. We mapped out that if some of them turned around and we lost 50% of our revenue overnight, we’d be down to $195k in monthly revenue.

As a team of 24, we would then be burning money (about $50-$100k/mo) and it might take us some time to recover from such a blow. With this round and $2m in the bank, we’ll be able to survive for 18-24 months, and hopefully in that time find new problems to solve and to grow revenue from.

Raising a non-traditional funding round as a non-traditional company: the middle way

A lot of the things we’re doing and experimenting with at Buffer might appear crazy to some, outright insane to others. This has influenced how unusual the round also needs to be.

In order to keep doing things the way we have, we feel that we need to control our destiny.

Since we’re so focused on culture-fit when growing the team, taking the traditional route that most startups take at our stage where you’d raise a large amount and hire 100 people within a few months is almost impossible.

Hiten Shah, one of our closest advisors once said something along the lines of:

“Well, you want to keep doing your crazy shit, right? So don’t give up control!”

This has been a large reason we’ve decided to raise this round in a very unusual way:

We found that traditionally, people believe there are 2 ways to build a company. You can bootstrap or you can be a venture-backed company raising Series A, B, C, and then eventually doing an IPO. For a long time we believed these were the only two ways. And, both have good things going for each other. However neither felt quite like the right approach for us.

A huge thank you goes out to Hunter Walk and Satya Patel from homebrew, who helped lay out a number of different paths, through which we ultimately ended up with what we’d like to call the middle way.

A few constraints that we wanted to solve for:

- We didn’t want to give up 20-30% of the company (the standard amount most VC’s aim for).

- We did want to raise some money, but not $10-20m.

- We didn’t want to give up control (through a board seat). We’re excited to work with new partners and over time understand whether further steps feel right.

- We didn’t want to raise huge amounts of money that we didn’t know how to spend.

- We didn’t want to be boxed in to IPO 5-7 years from now.

- We didn’t want to spend a lot of time fundraising, especially since this wasn’t about life and death for our business.

Interestingly, it’s not very easy to find firms that are comfortable with that. VC’s tend to have a “home run” mentality, which determines their economics for returns for the fund. Marc Andreessen did a great talk on that recently. This model is very proven and successful. At the same time, that mentality isn’t what we wanted to follow.

Interestingly there are very few firms that can help us solve for the above constraints. Luckily we have some great stories to share about some that we found and that we are very grateful to have on board:

Finding the perfect partners for the journey ahead

Finding the right people for this round wasn’t entirely straightforward. Luckily, compared to when we first raised money 3 years ago, we had a vastly larger amount of interest from various great parties.

At the same time, we tried to be focused on considering investors with the same discipline we have with hiring people for the Buffer team and also solve for our above mentioned constraints. So after speaking to a few dozen investors, a lot of whom wanted to give us a lot more money than we asked for, or who wanted to get a lot more equity than we wanted to give up, there were some that truly stood out and who we have been lucky to get on board:

1. Collaborative Fund (Kanyi and Craig)

When we first came across Collaborative’s About page, we were amazed. We couldn’t quite believe what we were reading. We both showed each other quotes about how they think about investing and how it was completely different to any other fund we’ve spoken with:

“First – Values matter. The world is changing.” – Collaborative Fund

It was likely the first firm we found that put a focus on values front and center, as literally the first thing they tell you about themselves. Another line was this:

“We recognize that our thesis limits the number of companies in which we are willing to invest.”

We routinely have to say no to hundreds, sometimes thousands of applicants that want to join the Buffer team. Sticking to your values requires a level of rigor and discipline that is challenging. Collaborative’s emphasis on this was striking.

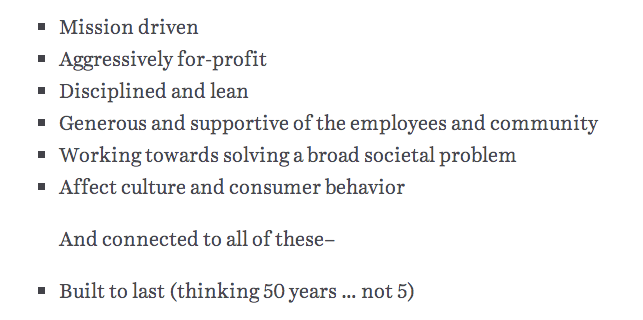

What really blew our minds was that they didn’t want to play the usual game that most VC’s are playing, where VCs need to get a return fast within 8-10 years. Instead they take this approach:

We were so hooked on working with these guys, we were 100% sure that we wanted to have them on board.

We met with Kanyi and Craig and our admiration only grew. Luckily after a few more meetings, Collaborative Fund committed to being the lead investor of this round with $1.5m.

2. Red Swan (Will Peng, Andy Dunn)

Together with Kanyi and Craig, we tried to think hard about other funds and investors that would be aligned with our slightly crazy and unusual approach. A firm that came to mind for them was Red Swan and Will Peng. We are long-time fans of Andy Dunn and his prolific and transparent writing on Medium and were keen to know more.

What got us excited was Red Swan’s values. In particular, something that we’ve slowly started to embrace and enjoy about the Buffer journey:

“Great companies are movements as much as businesses.” – Red Swan Ventures

They believe that the companies that are driven by a deeply authentic mission are those that create industry-defining change with long-lasting positive effects.

Our focus on transparency as a core value has inspired dozens, if not hundreds of other startups to date to become more transparent about their way of building their companies. It’s been equally incredible to focus on being completely distributed and show people that there is a way to let everyone on your team work from wherever they are happiest.

Our non-traditional round structure is new to them, but they worked hard to find a way that made sense for them to invest. Rather than invest out of their core seed fund, they syndicated to their LPs through a special purpose vehicle and invested alongside them. They found that this created the most alignment across entrepreneur, GP, and LP. We were floored by their LPs’ interest in our story and structure — Will told us that the response was immediate and had much more interest than we could accommodate.

Getting Red Swan on board (they are committed for $600k) has been another great success for us.

3. VegasTechFund (Andy White, Tony Hsieh, Will Young and Zach Ware)

The third partner, whom we’ve been admiring since the very start of Buffer, is Zappos, the Downtown Project and Vegas Tech Fund. One of the things that deeply impacted us at Buffer was a short interview Tony Hsieh gave, where he was asked “If you could go back and make one change to how you built Zappos, what would it be?” and his answer was this:

“If I could go back and do Zappos all over again, I’d come up with our values from day 1”

As soon as we heard this, we knew we needed to act on it. When we were 7 people, we put our values into words and it’s changed our company for the better ever since.

When we got the chance to meet Andy and Will from Vegas Tech Fund, we were amazed by how much importance they put on culture, even for investing. We travelled to Vegas and spent a day exploring the Downtown Project, which we believe is one of the most daring and exciting things going on in the world right now. The whole day we spent together was geared around interaction and how we were getting along, not at all about our pitch or numbers. At one point Andy said to us (paraphrasing):

“It’s funny, sometimes people expect there to be a point where we sit down and hear the pitch. That doesn’t happen.”

It was incredibly refreshing and reminded us a lot of our own hiring process, where over time we have started to remove the focus on skill and place much more emphasis on culture-fit.

Getting Vegas Tech Fund on board has been a dream come true and we’re excited to help bring company culture even more into focus.

4. Scott Bannister, Gokul Rajaram, Eric Ries, Hiten Shah, Adii Pienaar and other great angels

We’re also incredible excited to welcome some great angels as part of this round. Scott Bannister, who has already closed a syndicate on AngelList over $300k, Gokul Rajaram, Adii Piennar, Shan Mehta and a number of our existing investors are all part of this round again.

5. You?

This is where it gets fun! We still have about $350,000 left to raise in this round. Here is how you can invest yourself:

The valuation, term sheet and how you can invest in Buffer

First off, this round isn’t done yet! An important lesson we’ve learnt is that “A deal is not done, until the money is in the bank”. So although we’re very excited about all our partners that have committed, there are plenty of reasons that could still come up for all of this to fall through. The fact that we’re writing about this before the round is done, makes it even more exciting!

A few important facts about this round:

- The valuation of this round is $60m post-money (or $56.5m pre-money).

- We’re raising a total of $3.5m.

- $1m of the $3.5m raised will be used to fund company growth, $2.5m will be used to provide a small amount of liquidity for founders and early team members.

- For investors we’ve focused on downside protection through 1x liquidation preference plus 9% cumulative dividend.

- This means every year the investment accrues 9% interest payable on top of initial investment upon a sale unless the outcome in % terms is higher.

Here is the full term sheet:

Buffer Transparent Term Sheet – Series A

We still have $350k left to raise for the round. Here are 2 ways that you can invest in Buffer:

- Buffer will self-syndicate $150k which we will launch today at 10am PST, you can keep an eye on our AL profile here.

- Vegas TechFund has created a public AngelList syndicate that will go live today in the afternoon or tomorrow morning (Tuesday 28th of October). Keep an eye on their AL profile.

- Update: The first raise is going live here.

- Update 2: The first raise ($130k) is now closed. We have opened a new one with VegasTechFund now here

We’re excited to make this the most transparent fundraise done to date and share our thought process. Hopefully this can help you and others to learn how a startup might approach fundraising.

We’re truly grateful to have so many incredible supporters who have followed our journey over the years to this point. We’d love to answer any questions you might have on this in the comments below.

(And if you’d like to join us on this amazing journey at Buffer, we’d love to hear from you! We’re looking to add a number of people to our team in several key areas. Check out our jobs page for complete details!)

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.