How This Business Went From Losing $20,000 to Earning $1 Million in Just Two Years

Head of Communications & Content @ Buffer

Meredith Noble’s business journey began with a simple resolve to avoid traditional employment—she would do just about anything to avoid holding a normal job again. She had thrived in the corporate world, but she was frustrated by the glass ceiling on her earning potential and career.

Initially, this led her back to her family’s cattle ranch to assist with calving season. While out in the fields, she started thinking about passive income, and it occurred to her that she could teach grant writing online. She spent the next six months constructing course content, without the slightest clue about what she was doing, assuming that customers would sign up eagerly. But in the first year, she made only $2,000.

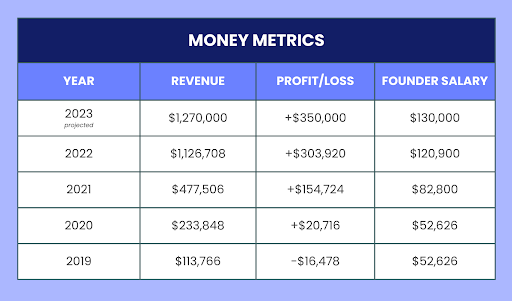

After nearly going under twice due to cash flow issues, she finally cracked the code for success, transforming her business from a $20,000 loss in December of 2020 alone to achieving $1 million in annual recurring revenue (ARR) just two years later. She’ll be the first to tell you that she couldn’t have done this without her co-founder and business bestie, Alexandra (Alex) Lustig.

Here’s a behind-the-scenes look at their journey.

Business Snapshot

Years in business: 6.5

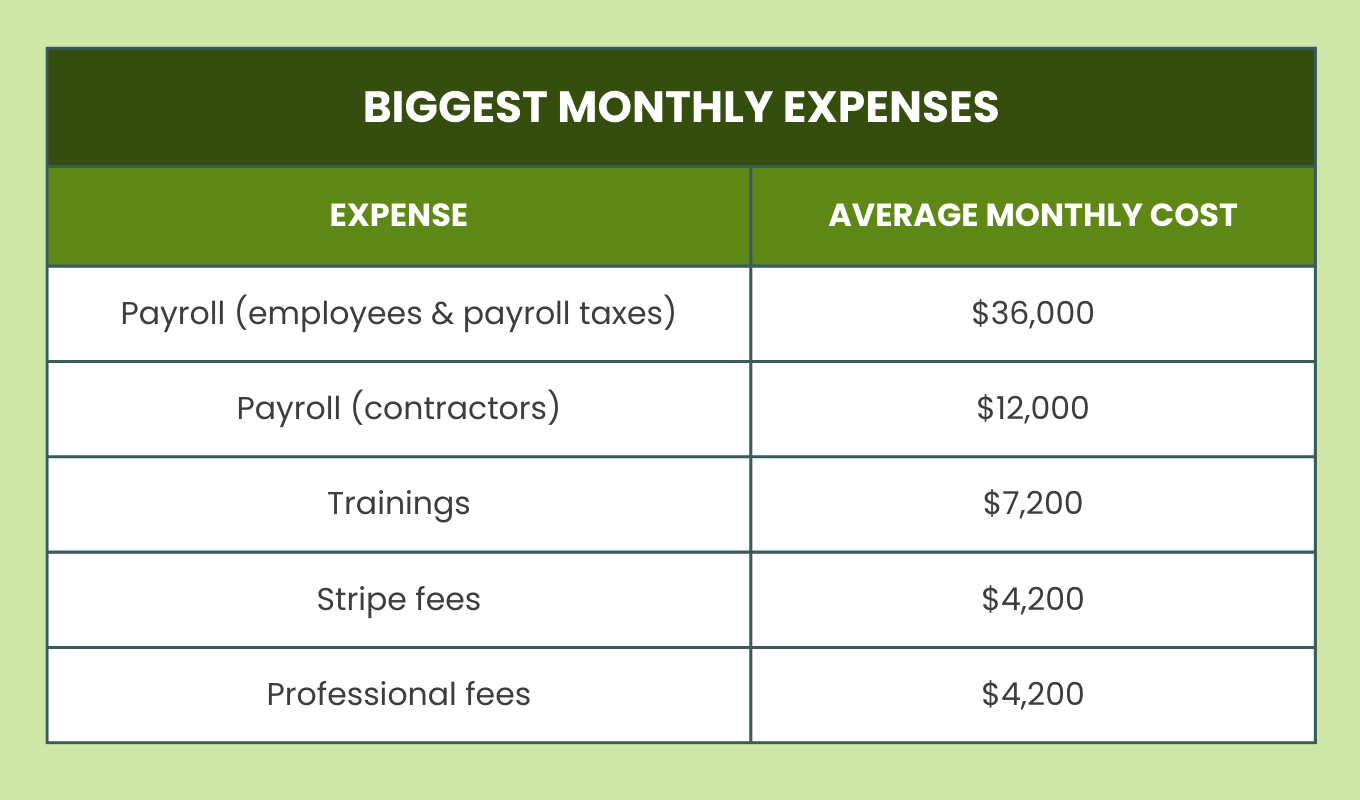

Number of employees: 4 full-time, 2 part-time, 6 freelance subcontractors

Location: Anchorage, Alaska with team members throughout the U.S. and as far away as Morocco

Initial capital invested: $5,000 Financial support for business: Sold stock from a former employer for startup costs; $7,000 loan from family

Revenue streams:

- The Global Grant Writers Collective: An online course, community, and coaching program priced at $500 per month. Book sales: We make some money from this, but it’s more a marketing and authority building tool for the Collective.

Growth Journey

What’s been your proudest financial achievement as a business owner?

Hitting $1 million in annual revenue. Within the first month of starting my business, I read an article in Forbes that said only two percent of businesses hit the seven-figure mark (even less for women-owned businesses), and that became my north-star goal.

I’m especially proud of this given that, in my business’ early years, I looked successful, but I was losing money with every new customer because I wasn't charging near enough. From that wake-up call, my co-founder and I learned to calculate what we call “Cost to Acquire AND Serve a Customer” (CASC). Most people just look at cost to acquire (CAC), but that doesn’t factor in the true costs of delivering on your promise to the customer.

To calculate CASC, we look monthly at marketing and sales expenses divided by the number of new members that month. Marketing expenses are things like ads and sponsorships. Sales expenses (for us) are inclusive of all team and contractor wages since we’re all needed to support a customer to success. An example would be marketing expenses of $15,000 plus sales expenses of $50,000 divided by 35 new customers—a CASC of $1,857. (This is a true example from our business!)

This sounds complicated but it’s really a simple equation to make sure our prices are high enough—especially as we continue to improve our product (which often means higher expenses!).

After learning about the true cost of being in business, my co-founder and I realized we needed to triple our prices and switch to a monthly payment plan option that provided monthly recurring revenue. We went from losing $20,000 in the month of December 2020 alone and having only six weeks of runway left to earning $7,000 MRR in January, steadily climbing until we did $1 million in ARR just two years later.

What have you found is worth paying for to help you grow, and what have you been able to achieve more scrappily?

Hands down, the best investments for growing my business have come from investing in other programs and coaches that have been where I want to go. I’ve learned that wisdom comes from experience, and when you don’t have the experience, it’s important to find others that can guide you.

I’ll buy anything I can get from business coach Dan Martell. (I actually spent $25,000 to buy 500 copies of his book to get access to a two-day mastermind at his house.) I also love Victoria Song, author of Bending Reality, for mindset coaching.

While I was definitely scrappy in the early days while we were figuring out product-market fit, I haven’t taken that approach since. If I need to deny myself investments, I see it as proof that my business model is off. That almost always means prices are too low!

How do you decide how much to pay yourself versus invest back in the business?

I first learned what to pay myself from Dan Martell. His approach is that owner’s pay is 50 percent of top-line revenue up to $250,000 in revenue. It then goes to 35 percent until hitting $500,000 in revenue. Then 20 percent until hitting $1 million in revenue.

I have followed these benchmarks generally, though I have a co-founder earning equal pay so some of our compensation has come from the operating expense allocation.

I only started taking an owner’s draw in excess of tax payments once hitting $1 million in annual revenue. Otherwise, I continued to pile all earnings back into the business (besides my salary).

Now that we are in the $1 million to $5 million stage of growth, we are in the “danger zone”—when you have enough money to make expensive mistakes. You think you have things figured out and then realize what got you to $1 million won’t get you to $5 million. For that reason, we are being conservative in what we pay ourselves so we have the cash flow to make bigger investments in the business for innovation.

Tell us about your team. At what point did you decide to hire employees or contractors? How do you think about when and who to bring on now?

I started hiring contract help immediately. I even hired help when I was a temp employee at the local transit department so I could bill more hours than I personally wanted to work!

My hiring strategy follows the advice offered by Dan Martell in his book Buy Back Your Time. The essence of the strategy is to hire back your time, so your time is free to work on higher revenue generating activities. The best starting point is hiring someone to manage your inbox. As scary as that sounds, you’ll never go back!

My team consists of myself as Visionary, my co-founder Alex as Integrator/Operator, a marketing lead, a customer success lead, business operation assistant (part-time), four contractor coaches, and specialized contract support like a website design team.

Every job I just described I used to have. I coded the website. I did all the coaching. I uploaded receipts. All of it. By systematically bringing on help to replace me (and now the time of my top employees), I get to focus more and more in my zone of genius.

What specific strategies or marketing techniques did you employ to attract your first customers or clients?

We focused on one extremely narrow niche with one product offering and one marketing distribution channel until hitting $1 million in annual recurring revenue. Our growth strategy was search engine optimization (SEO), and we committed to it in all senses of the word. We focused on optimizing our website and producing blog content that would index well.

I used a process I call “dreamy customer journey mapping” to learn what my ideal customer wanted and needed. Here’s how it works: We interviewed 25+ individuals that we wanted to have as a customer or were enjoyable existing customers. We asked a series of strategic questions (which I share here) to discover their hopes, fears, and needs. We recorded the interviews and had them transcribed, then highlighted the catchy sentences for use in our marketing content. We use our customer’s exact language so well that they think Google is listening inside their brain.

This is now an annual part of our business so we can always stay in touch with what our customer’s evolving needs are. This one simple—but often overlooked—strategy is where you must start if you are stumped on where to find more customers.

What are a few of your most impactful growth strategies now?

SEO continues to be a main driver. We have been consistently publishing YouTube videos once a week since 2019, slowly increasing the quality over time. Amazon is the third most popular search engine. My book, How to Write a Grant, was not titled that way by accident. It is one of the most popular searches and one of my best marketing tools.

Now, we want to have million dollar months, so we are thinking about what additional growth strategy we would like to optimize next. We are testing a few different strategies like ads, guest podcasting, utilizing a sales team, innovative product development, partnerships—you name it! We’ll pursue another six months of experimenting and then decide how to best prioritize our growth strategy moving forward. The big takeaway here is that we optimized one channel completely before focusing on another to not stretch resources too widely.

What’s a turning point that really impacted how you thought about your business or approached growth?

Realizing that my intuition won’t grow the business. I’m not negating the incredibly important role of intuition in making decisions, but what I have found is that intuition won’t guide me efficiently toward growth.

Once I locked onto this realization, I stopped shaming myself for not having a clear vision for our next phase of growth. I stopped guessing at what the business should do with limited resources. The only times in my business we have truly achieved quantum leaps is when I received coaching from others who have done it before.

What have been the greatest growth or money challenges you’ve experienced? How have you worked through them?

I’ve had two major near-death moments, which in business means running out of cash.

The first one came after I had published my first book and was relaunching my online course. This was right before the pandemic and people were still timid about learning online. I believed a live workshop would sell better and give me the ability to then sell an online course—so I took a leap, took a loan from the Bank of Dad for $7,000, and launched a series of four-hour grant writing workshops. Not only did these make me about $20,000 in revenue, but I also converted around 20 percent of the audience to buying the online course. That loan saved the business at that time.

The second one was about six months into running the online course business. I had decided to close down my consulting business to go all in on the course. It was brutally hard turning down those large annual recurring consulting contracts I’d held for years, but I knew that as long as my attention was split, that I would never build my dream business. Unfortunately, we kept losing money. I was only charging around $350 per student for a grant writing course, and they were served for a lifetime. You can only lose $20,000 in a single month before your piggy bank empties itself.

I was out of ideas. Utterly deflated. It was the first time I truly questioned if I was cut out for entrepreneurship. I knew it was in me—I just couldn’t figure out why I wasn’t succeeding.

In simplest terms, we turned around the business by going courageously narrow with our niche audience, tripling our prices, restructuring and improving our offer, and revamping our sales funnel process. We did all of this within three weeks. Everything we did started with the dreamy customer journey map I talked about earlier. By focusing on a woman who wanted to freelance (our original niche segment), we spoke directly to her in our email and website copy. We also simplified the process for becoming a customer: For instance, selling by webinar and having automated email sequences.

We did $7,000 in monthly recurring revenue in January 2021 and grew $4,000 in MRR every month thereafter. This means we went from near collapse to $1 million in annual revenue just two years later.

You know you’re learning when you take different actions when faced with the same circumstances. It was a rocky road that begged me to quit, but every quantum leap in my business came from those near-death moments.

What are your next growth goals? What do you plan on investing in to help you achieve them?

Our next growth goal is $12 million in annual revenue. I like the idea of having million-dollar months! Plus, I once read a statistic that only eight out of every one million businesses hit that financial milestone.

I’ve realized this growth hinges on my own personal development. I have run into my own limiting beliefs and self-created constraints that are keeping me in the “safe zone.” The business will only grow as much as I have as a person and leader, so I have relaxed on marketing strategies and allocated resources toward my growth and that of my employees.

In addition to personal development, my plan for achieving the next level of growth is by mastering substitutability—the concept that others can do my job.

Based on your experience, what advice would you give someone who had a business like yours for growing successfully?

Learn to read financials. The year I finally committed to learning how to read a profit and loss statement, income statement and balance sheet—and not be afraid of taxes—was when my business took off.

Energy goes where attention flows. Lean into watching your money and understanding how it works. Otherwise, things can go sideways and you won’t know until it is too late.

It can also help to build a financial team around you from day one. Pay for an excellent accountant and bookkeeper. Invest in the best software. Don’t try to do this work yourself to save money. You will only cost yourself more by making expensive mistakes that someone else could have prevented—while you spend time in your zone of genius.

Try Buffer for free

180,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.

Related Articles

🖤At Buffer, we’ve long aimed to default to transparency, a practice we believe helps eliminate inequality and gives everyone a greater chance of succeeding. Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well. Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how

🖤At Buffer, we’ve long aimed to default to transparency, a practice we believe helps eliminate inequality and gives everyone a greater chance of succeeding. Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well. Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how

🖤At Buffer, we’ve long aimed to default to transparency, a practice we believe helps eliminate inequality and gives everyone a greater chance of succeeding. Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well. Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how