Over my career, I have been fortunate to work for several different organizations, all of which have been in completely different stages of their marketing maturity.

Regardless of what stage they are in, one of my first priorities is creating in-depth marketing personas.

Marketing personas are like the foundation for building your marketing house.

Without personas, how do you know which message will appeal to your target market’s needs?

Or where to reach your audience to build awareness and drive them to your website?

Or what to write about in your content marketing efforts?

Or how to talk to your audience on social media?

The problem is, most of the literature on marketing personas takes you down the path toward: “John has a wife, 3 kids, and a dog’ … which has never proved all that helpful for me. How does John’s family portrait help me write good copy or content that gets him to buy my product? It doesn’t.

That’s why I wanted to write this article to share my experiences and learnings from creating marketing personas at several companies over the years. Let’s dive into the details.

What are marketing personas?

My favorite definition of a marketing persona comes from Ardath Albee, who I think is probably the definitive source for B2B personas. Her definition is:

A marketing persona is a composite sketch of a key segment of your audience - Ardath Albee

Let’s break that down a little bit:

- Composite sketch – A marketing persona is not supposed to detail one specific person and should never be based on one specific individual. Instead, it is a composite sketch that should reflect the majority of people it is supposed to represent.

- Key segment of your audience – A marketing persona is meant to represent a segment of your target market, not the whole thing. If your target market is ‘Marketers,’ it is perfectly acceptable to have multiple personas for the different types of marketers so long as there is enough of a difference between them to warrant a separate persona. You may have multiple marketer personas broken up by business size, or industry, or whatever makes sense for your business.

It can also be worth looking beyond the traditional ‘buyer’ when creating your personas.

Here are a couple of other personas I have developed and used in different ways that you may want to consider:

- Detractors – Detractors are the other people in the buying cycle who can potentially derail the sale even if your main persona is all for it. This is particularly common in complex B2B sales with longer sales cycles and multiple people involved.

- Influencers – Influencers are people that, although they may not directly buy the product, are influencing the actual buyer so significantly and at such a scale that it is worth investing time into these people. A good example of this is accountants who tell small business owners which accounting software to use or web designers who tell their clients which CMS to use.

- Anti-personas – An anti-persona is the exact opposite of a marketing persona. It is a fictitious character representing a set of people who aren’t your target customers. Just to clarify, creating an anti-persona isn’t saying you’re going to actively block these people from using your product or service, it’s just saying you’re not going to focus your marketing efforts on acquiring these people. Here are a few scenarios where it makes sense to have an anti-persona:

- Price > Budget – The number one reason why you may want to create anti-personas is if there is a particular customer who you know simply cannot afford your product. If you're selling a piece of software for $1,000 per month, then it is highly unlikely the average small business owner can afford it (unless it’s mission-critical). Therefore, by creating an anti-persona for this person and understanding factors like where they hang out online, you can understand how to not waste your marketing efforts attracting people who will never be able to afford your product.

- Positioning – There are also times when not going after a particular type of customer is a positioning or competitive differentiation tactic. At Campaign Monitor, we deliberately chose professional marketers at 50+ employee companies as our Marketing Persona and had an anti-persona of the small business owner as a way to position ourselves against MailChimp and Constant Contact, who focused heavily on the small business market.

4 steps to creating marketing personas

So now that you understand what the different types of personas are that you can possibly create, it’s time to start creating them.

Having done this a few times now, I’ve found that there are typically four steps:

- Quantitative Analysis

- Qualitative Analysis

- Drafting the Persona

- Socializing the Persona

Let’s dive into each in more detail.

Stage 1: Quantitative Analysis

If you have a horizontal product or service that isn’t exclusively used by one market segment (i.e. Buffer is used by people from many different industries, job roles, etc), then this is a critical stage to understand what your key customer segments are.

On the other hand, if you have a specialized product like an order management app for surfboard shapers, then you likely already know who your target segments are – surfboard shapers – and this stage may not be as important.

Regardless, here are the steps I take to complete a quantitative analysis and find out who our target segments are:

- Collect a list of customers

- Analyze the list at the company level

- Analyze the list at the individual level

Here’s more on each stage.

1. Collect a list of customers

Start by getting together a list of all paying customers, with as much information about each customer as possible.

What information you include will depend on various factors, including industries served, your sales process, etc. Here are a few dimensions I’ve found useful in the past:

Demographic Information: This includes basic demographic information about the company, including things like:

- Company Name

- Industry

- Company Revenue

- Number of Employees

- Country

- City

Revenue Information: This includes information on how much revenue you make from each customer, including things like:

- Annual Contract Value

- Total Lifetime Value

- Average Spend Per Transaction

Engagement Information: This includes information on how deeply they are engaged with your product or service and could include things like:

- Number of logins per month

- Number of users using the product

- Number of documents created, social media posts sent, etc (I.e. whatever your product actually does)

2. Analyze the list at a company level

Once you’ve pulled together a list of customers with your chosen attributes, it’s time to start analyzing that list and looking for trends.

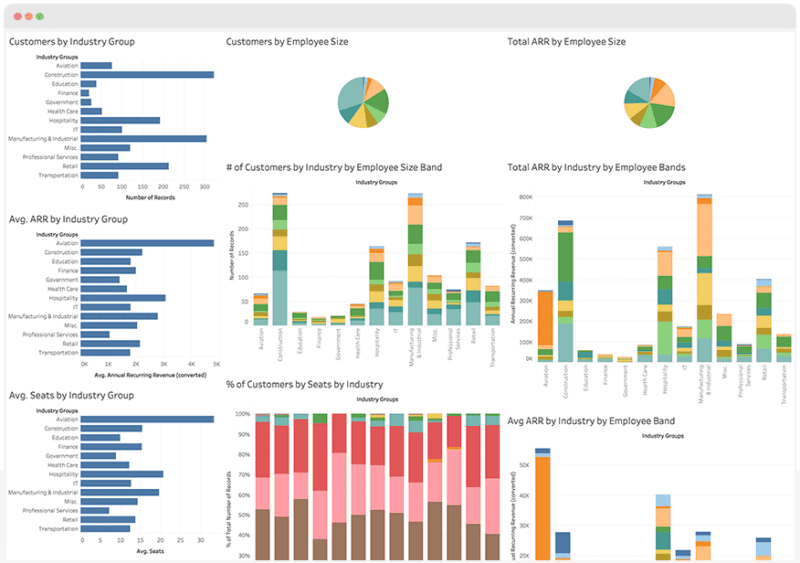

My favorite tool for this is Tableau, as you can simply drop the Excel sheet of your customers into it and create an amazing array of charts and graphs, all just dragging and dropping.

Some analysis I’ve found useful in the past includes:

- Number of customers by industry

- Avg. revenue by Industry

- Number of Customers by Employee Size

- Number of Customers by Country

- Avg. revenue by Employee Size

What you’re trying to do here is find trends that give you some insights into who your best customer segments are.

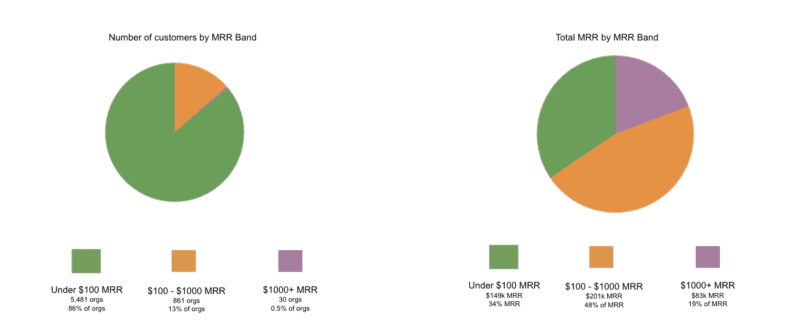

For instance, in a quantitative analysis at a previous company, I broke down our customers by revenue band (i.e. how much they were paying us). In the process, I found that even though 83% of our customers were paying us between $0-$100 per month, that percentage customers only made up 34% of our revenue.

On the other hand, the segment that was paying us between $100-$1000 per month only made up 13% of our customer base but accounted for almost half of our revenue.

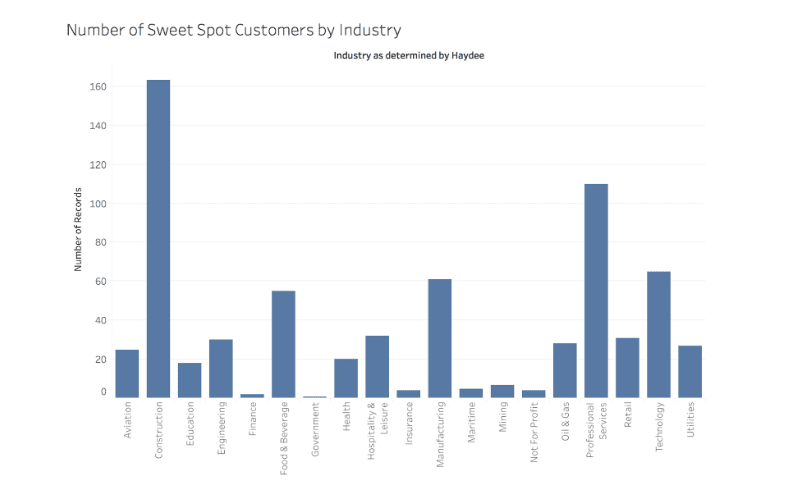

Based on this insight, we started to look more deeply at who these ‘sweet spot’ customers were (i.e. the ones paying us between $100 and $1000 per month) and found that they were largely from a few key industries:

Based on this insight, we started to target Construction, Food & Beverage & Manufacturing as our key segments (Professional Services, although large on the graph above, is actually a mix of lawyers, accountants, PR firms, etc, which, when broken into each industry, were not a significant volume).

3. Analyze the list at the individual level

Now that you know who your best customer segments are at the company level (i.e. construction companies with 100-1000 employees), it’s time to then find out who the ideal customer segment is at the individual level (i.e. who is it within these companies that you need to be targeting).

And if you want to make the process a little easier, you can always use a free buyer persona builder like HubSpot Make My Persona. Just add details similar to what I covered and the platform generates an easy-to-follow template. This is also handy to standardize the drafting process if you plan on targeting multiple different personas.

The process for this is largely the same as above. Gather a list of all the customers in your sweet spot (I.e. construction companies with 100-1000 employees) and then include in that list information on the primary buyer/user of your product.

This could include information like:

- Job title

- Department

- Gender

- Seniority (VP, Manager, etc)

Once you’ve got this together, load it into your chosen analysis tool and start to build some graphs and charts to see what you can learn.

Continuing the example above, we found that within Construction Companies, it was primarily the Project Manager that was using and purchasing the product, so they became our Marketing Persona.

Stage 2: Qualitative Analysis

Now that you have a good understanding of who your target segments are, at both the company and individual level, it’s time to start learning more about these people.

In my opinion, the most effective way to do this is good old-fashioned customer interviews.

Here’s the process I generally go through:

Step 1: Outreach

The first step is setting up interviews (phone or in-person if you can do it) with your existing customers.

To do this, I generally pull the names and email addresses of everyone I want to reach out to into a spreadsheet and upload it into a CRM / sales automation tool, which can help with sending a series of emails to each of these customers and organizing your efforts based on who replies or who needs further follow-ups.

Here’s a template for an email series I’ve sent in the past:

Email #1

Hey John

How are you?

My name is Aaron Beashel, and I am the [Position] at [Company Name]

I’m reaching out as I’m interested in learning more about how you use our product, what benefits you get from it, what you were using previously, etc. I want to feed this information to our marketing, product & support teams so we can make [Product Name] better for you.

Would you be willing to speak with me for 30 minutes over the phone and tell me a bit more about how you use [Product Name]? If so, you can simply click here to select a time that works best for you, or you can reply to this email, and we’ll work out a time.

Look forward to speaking with you, John!

Aaron

Email 2 – Sent 3 days after the initial email

Hey John

I just wanted to follow up on my previous email and see if you had 30 minutes to tell me about how you use [Product Name].

As I mentioned, the goal of this is to learn how customers like you are using the product so that we can ultimately make it better for you.

If you’re up for a quick chat, you can simply click here to select a time that works best for you, and I’ll give you a call then.

Look forward to speaking with you, John!

Aaron

Email 3 – Sent 6 days after the initial email

Hey John

I know you’re super busy, so just wanted to send you 1 final email and see if you had 30 minutes to chat with me about your use of [Product Name].

If so, you can simply click here to select a time that works for you, and I’ll give you a call then.

If you can’t spare the time, that’s all good too. I really appreciate you using [Product Name] and hope it’s all going well for you. If there is anything we can ever do to help, please don’t hesitate to reach out to our support team at [Support Email].

All the best!

Aaron

As you can see, these emails contain links to a page where people can book a time that suits them. I typically use Calendly for this.

The reason it’s essential to include these links is it prevents you from having to exchange 10 emails back and forth with each customer trying to coordinate times, which is a massive timesaver for everyone. I’ve also found it increases the number of interviews you actually get booked (as it makes it easier for people to book them).

Step 2: Conduct the interview

Once you get some interviews booked, it’s time to start getting on the phone and learning from your customers. After doing 100+ of these interviews, I’ve developed a bit of a template for what questions to ask and have included my favorite questions below, along with a bit of context as to why I ask them and what I hope to learn from each one:

Q1: Can you briefly describe your business? I’m interested in understanding the size, primary expertise, location, etc.

I recommend starting every interview with this question. It gets people talking and gives you a bunch of information you can use to segment the answers to later questions (I.e. looking at how large enterprises respond vs small businesses)

Q2: What is your role within the organization? What department does that fall in? How many people are on your team?

This question gives you a good insight into who is using your product (particularly for horizontal products that could be used by any department, like project management tools, for instance). It can also help to segment responses to later questions (i.e. What are marketing teams using your product for vs finance departments).

Q3: What are the main goals and KPIs of your role?

By understanding the main goals and KPIs of your target audience, you can create messaging that showcases how your product helps potential customers achieve the things they’re being paid to achieve.

Q4: What are the main frustrations and pain points in your role?

By understanding the biggest pain points & frustrations, you can create messaging that showcases how your product can solve those pain points and help them achieve the goals and KPIs of their role (as learned in the previous question)

Q5: What do you use our product to achieve?

At its core, people ‘hire’ your product to achieve something they need to achieve. By understanding what job people need your product do, you can create effective messaging that showcases how your product can help get that job done.

Q6: Please briefly describe how you achieved this before you found our product. What were the problems associated with this method?

By understanding what people were previously doing to achieve whatever your product helps them achieve (and the pain points of the previous method), you can create effective messaging that convinces them to change their process and use your product.

Q7: What is the main benefit you get from using our product?

By understanding the main benefits people get, you can start to create a messaging hierarchy that focuses on the main benefits people are getting rather than on some other benefits that you might think are important but actually aren’t. These responses are also interesting when segmented by role, industry, company size, etc, as they allow you to see the value different types of users get from your product (I.e. A CRM makes it easier for Sales Reps to remember to follow up prospects, but a Manager mainly gets value from the reporting & forecasting features).

Q8: What triggered you to seek out a solution like ours?

Best asked to newer customers, this question helps you understand what internal business events trigger people to seek a solution like yours and can help you devise sales & marketing strategies to find these people when they’re in an active buying state or even cause the buying trigger to occur.

Q9: What are the top 3 things you’re looking for in a product like ours?

Understanding people’s priorities when searching for and assessing a tool like yours can help you create effective messaging & content that shows how your product is the best fit for their needs.

Q10: What does your buying cycle look like for a product like ours? And who’s involved?

This question can give you a good insight into the buying committee (or lack thereof) that would be involved in purchasing your product and can inform everything from your website content to the sales process you build. For instance, if you know someone from the IT person who often gets involved in the sale and cares about things like security and data governance, you can prepare content that addresses their concerns and speeds up the buying cycle).

Q11: What was your biggest fear or concern about using our product? Was there anything that almost stopped you from signing up?

Understanding the various things that are stopping potential customers from signing up for your product allows you to focus time and effort on removing those blockers and increasing conversion rates. A good example is LogMeIn, which surveyed people who downloaded their app but didn’t go on to use it. They found that people weren’t sure the product would stay around, as they weren’t sure how the company was making money. By making the pricing more prominent in the app and on the website, they increased conversions by 300%.

Q12: What magazines, news sites, trade shows, blogs, etc are you reading to get professional information?

If you have a good understanding of where these people are getting their information from, then you can plan top-of-funnel activities to reach them. For instance, if you know they all attend a particular event then you can plan to go to it, or if they’re actively involved in LinkedIn communities then you can try to promote your content there.

Step 3: Write up the responses

Although it takes a little bit of extra work, I’ve found it to be incredibly valuable to write up a summary of each interview in a spreadsheet (usually right after the interview is complete). Doing this gives you several advantages:

- All the answers in one place – If you just have your rough notes from each interview in individual documents, it’s impossible to see all the answers to a particular question in one place, which makes it very hard to identify the trends. By summarizing all the responses in a spreadsheet, however, you can simply look down a particular column and see everyone’s answers to a particular question in one go, making it easy to identify trends.

- Segmentation – By summarizing all the answers in a spreadsheet and including some relevant data on each customer like industry, job title, company size, etc, you can then start to segment your answers and see how people in particular industries answer a question or in companies of specific sizes.

- Sharing – Every time I’ve done this exercise and produced Marketing Personas, somebody has wanted to see the raw qualitative data behind them. By having all the interviews summarized in a spreadsheet, you can very easily share them.

Here’s a copy of the spreadsheet I use to summarize people’s responses. You’ll see the columns for summarizing answers line up with my question template above, but feel free to copy it and add or remove anything to make it your own!

Stage 3: Drafting Personas

Now that you have a good understanding of who your target segments are and have conducted a bunch of interviews with them, you should have all the information you need to start drafting your Personas.

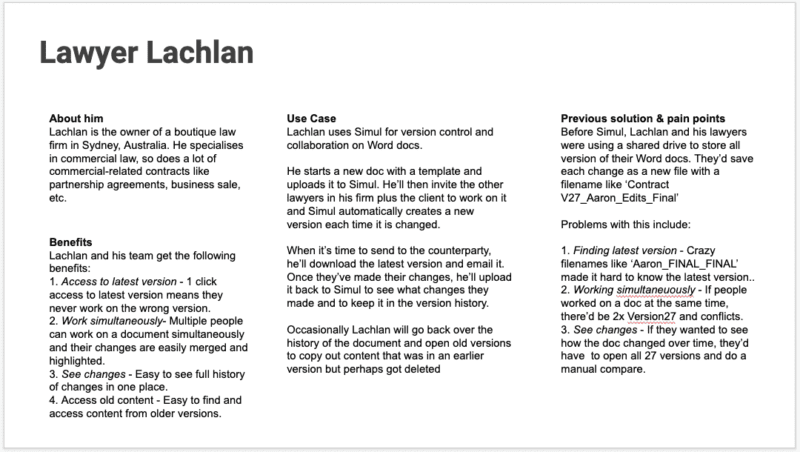

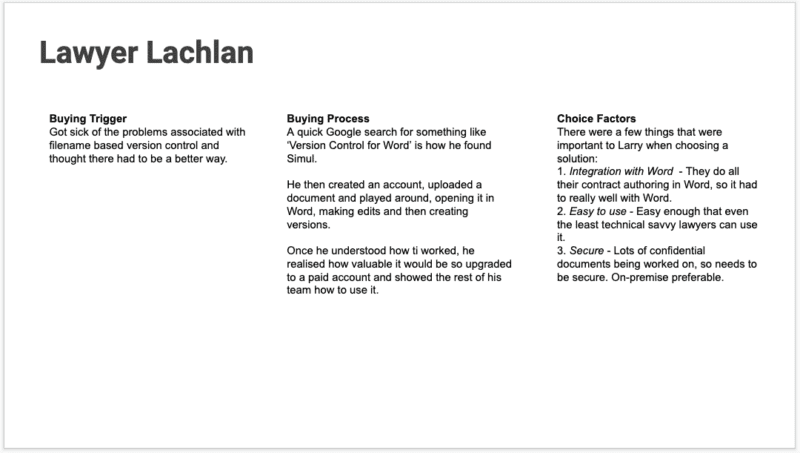

Again, over the years of doing this, I’ve developed a bit of a template for how I like to present the information, and you can see it in action below:

The above Persona is for a version control and collaboration tool named Simul Docs, whose primary target market is lawyers. As you can see, it includes key information such as:

- About Them – A summary of information about them, including their role, industry, company size, etc. All the relevant demographic information essentially.

- Use Case – A summary of how they use our product, what they’re trying to achieve with it, etc.

- Previous Solution & Pain Points – A summary of how they were achieving things before your product and what the pain points of that previous approach were.

- Benefits – A summary of the main benefits they get from using your product.

- Buying Trigger – A summary of what causes them to seek out a product like yours

- Buying Process – An overview of the typical process people go through to buy your product

- Choice Factors – An overview of the kind of things they’re looking for in a product like yours

Again, all of the sections in this Persona are directly aligned to the questions I ask during the interview, so feel free to add or remove whatever sections are most relevant to you.

Stage 4: Socializing the Personas

Now that you’ve built your Buyer Persona, it’s time to get the information into the hands of the people who will use them.

How you go about this will likely depend on the structure of your organization, who will be using them, etc, but here are a few ideas from ways I’ve done this in the past:

- Present them to your company: Put together a presentation that highlights the buyer personas you created, along with information on what buyer personas are, how they are to be used in your organization, your methodology for creating them, examples of customers for each persona, etc., and do a presentation to your company. This might be at an all-company meeting or perhaps just to a few key teams.

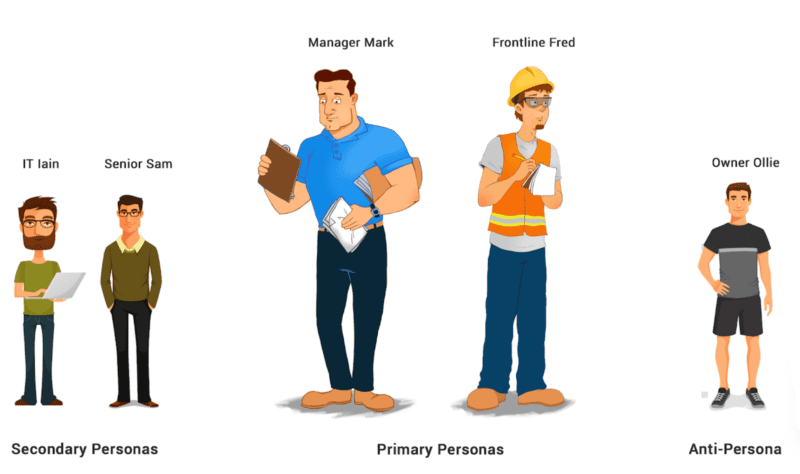

- Create merchandise: At SafetyCulture, we got one of our designers to come up with some custom illustrations for each of our personas.

We then put each of these characters on posters in the various offices and meeting rooms worldwide to keep the customer and their needs front and center as employees make decisions.

- Invite real-life customers to talk to your employees: Remember, a Persona is simply a fictitious representation of a real-life set of people, so why not get some of those real-life people to come and tell their stories? Qwilr, a software tool for creating proposals and quotes as beautiful web pages, regularly invites customers to their offices for team events such as Friday afternoon drinks. The customer will generally do a little bit of talk or answer some questions about how they use the product and then stick around to hang out with the team. It’s a great way to keep the Personas and the customers they represent top of mind long after the initial presentations and excitement are over.

Conclusion

Marketing personas are the foundation on which you can build your marketing function. Without them, it’s almost impossible to know how to message your product to talk to customers’ pain points and needs or how to reach them to build awareness and drive them to your website.

Given how much they inform almost everything else in your marketing function, it’s important to get them right. So take the time to do the quantitative and qualitative research and build personas based on real customer insight, as it will pay off in the long run.

Try Buffer for free

190,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.