COVID-19 Economic Impact: Message #3

Former Director of People @ Buffer

This team communication regarding COVID-19 is part of our COVID-19 Response Series. You can see all the messages in the series here.

- Shared: March 18, 2020

- Posted by: Caryn Hubbard, Director of Finance

- Title: How we’re positioned to handle this new economic climate

How we’re positioned to handle this new economic climate

Hi team,

The last couple of weeks have been atypical and unprecedented, unfolding in ways none of us could have imagined. Public health concerns have become the most important priority across the world. Developments are changing rapidly and the last week has been tumultuous for the economy. Investors are fearing that the toll on the global economy will be even greater than we’ve seen.

Today I’d like to share that although there is much uncertainty beyond our ability to predict, Buffer is in a strong financial position to weather the economic impact of an inevitable downturn.

To be clear, there is no need to worry about our revenue or financial position right now. We’ve spent the last few years building up to today’s financial position – which means we can weather extreme levels of uncertainty like this. We’re fortunate to be in such a stable financial position and I don’t take that for granted.

That said, corporations around the world are issuing statements about profit concerns and sharing how they’re repositioning activities as the coronavirus spreads. What one of the world’s largest investment firms warned last week (“a short recession is inevitable”) quickly became outdated over the past couple of days. Economists are now sharing that deep contractions are expected and a recession deeper than we’ve ever seen is inevitable.

Treasury yields in the U.S. are at historic lows – this market is essentially the backbone of the U.S. economy and drives everything from trading to fiscal policy. The Federal Reserve recently shared that it is injecting $1.5 trillion into Wall Street to curb disruption.

All of this impacts interest rates for borrowing, international currency exchange rates, investment portfolios, consumer spending, business decisions, and our shareholders interests. Although Buffer is well positioned, we’re not entirely insulated from experiencing a financial impact.

I’m mindful that this is the time to maintain flexibility on our balance sheet – maintaining our strong cash position (consistent goal of 4-6 months operating expenses on hand), staying reasonably leveraged, and continuing to be intentional about our growth and budget commitments. Our product strategy focus is a key priority so that we aim to stay ahead of any compounding negative growth we may experience over the next 3-6 months.

It’s also prudent for us to create contingency plans to avoid any surprises – we’ll be modeling these out more thoroughly on the finance team.

As I shared in the recent financial update, we’ve started 2020 with two months of net income and cash flow that exceeded our projections. Our net profit was $450k for February – outstanding. Imagine a future, worst case scenario where we’re burning cash each month and have a net loss of $100k for several months. With $6.4M in the bank, it would take 64 months to burn through our cash. This exact scenario is unlikely, but it illustrates the power of a strong cash position.

What we are doing right now

Budget Review: I’m reviewing our 2020 budget plans (revenue forecasts and expense commitments) as part of our Q1 review so that we can make any essential Q2 and Q3 adjustments within the Execs team. This will include repurposing budgets such as travel to other essential areas, as well as “cushioning” for the uncertain.

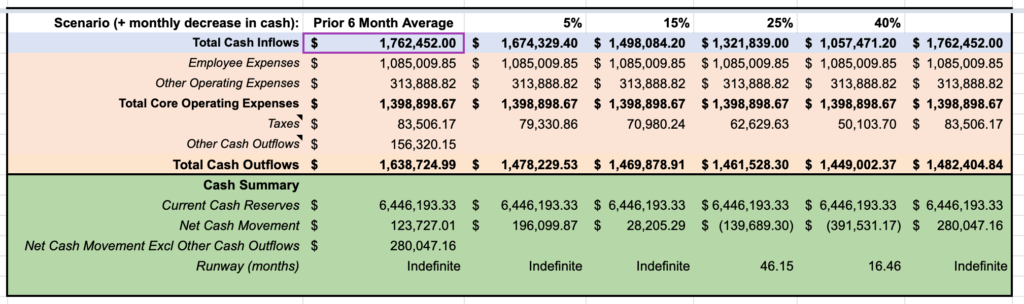

Cash Analysis: Today, we completed a first phase cash analysis that takes into account a handful of downturn scenarios so that we have a solid pulse on what varying levels of downturn mean for our cash position. In summary, we have a range of “indefinite”cash runway to 16 months in a very extreme scenario where our incoming cash drops by 40%. We are in an extremely solid cash position today.

Customer Churn Projections: We are working to gain a deeper understanding of our current distribution of customers so that we can make our best predictions of any increases in churn we may see as businesses and consumers respond to the impact of the global pandemic.

We’re working together with the Data team to gather data and do an initial analysis that we will plug into our revenue forecasts.

Alongside these quantitative metrics, the Advocacy team has been surfacing the messages from customers who are impacted by COVID-19, and we aim to start to more deliberately examine and share those qualitative insights to create a holistic view of the impact on our business and how things are evolving.

We know that our customers will be impacted to varying degrees. Businesses who are reliant on supply chains, the travel industry, hospitality industry, concerts and event planning, and so many others might be experiencing severe disruption to their operations. Others may have mild disruption or are simply preoccupied and fearful. We know that many businesses are also inundated with information and notifications as we are, and that they are reconsidering priorities, social media marketing strategy, and in some cases how much runway they have to weather such uncertainty.

We’ll need to be adaptable, accept that we can’t predict all outcomes, and do what we can to meet our customers where they’re at.

In summary, it’s my top priority to stay on top of the rapidly evolving news, to have frequent discussions with those in our professional network which we’ve worked hard to build solid relationships with (corporate attorneys, bank partners, lenders, fellow finance professionals), and to apply those insights to our financial position at Buffer.

And I’m certainly not doing this alone. Joel is also doing the same and speaking often with other founders and those in his network. We have committed to touching base regularly, sharing our insights, and reassessing our assumptions as things change.

In addition to our budget review, ongoing cash analysis, and churn analysis, I’ll be communicating frequently with the Execs team so that all are aware of the company’s financial position while they are continuing to lead their areas of the company.

We’re in this together, and I find it so grounding to recognize the strengths in the team around me – the Execs and leadership team, the Finance team, and the People team who I work so closely with every day. I know that we’ll get through these challenging times and come out even stronger.

With Gratitude,

Caryn

Try Buffer for free

180,000+ creators, small businesses, and marketers use Buffer to grow their audiences every month.

Related Articles

No one knows how to work during a pandemic, and we’re all grappling through it together. So in the spirit of sharing, here are all of the internal messages we’ve shared with our team and shareholders during this time.

This team communication regarding COVID-19 is part of our COVID-19 Response Series. You can see all the messages in the series here . * Shared: March 4, 2020 * Posted by: Courtney Seiter, Director of People * Title: We are postponing our planned June retreat in Athens We are postponing our planned June retreat in Athens Hi team; I have some tough news to share: In light of the COVID-19 situation developing across the world and out of an abundance of cautio

This team communication regarding COVID-19 is part of our COVID-19 Response Series. You can see all the messages in the series here . * Shared: April 3, 2020 * Posted by: Joel Gascoigne, Buffer Founder and CEO * Title: Launching the COVID-19 Customer Assistance Program Launching the COVID-19 Customer Assistance Program Hey team, I’m glad to be sharing an update with you on how we’re planning to continue and expand the ways we’re helping customers get throu